The value of the euro weakened ahead of the ECB rate decision with EUR/USD dipping under 1.23. Does this imply that Quantitative Easing is already baked into the price?

The team at Goldman Sachs explains why the price of the pair is far from reflecting QE:

Here is their view, courtesy of eFXnews:

Goldman Sachs expects the ECB to stay on hold at its December policy meeting on Thursday (ECB Main Refinancing Rate at 0.05%), and doesn’t expect further specific measures to be announced. That said, GS believes that President Draghi will likely reinforce the dovish stance adopted in his Frankfurt speech on November 21.

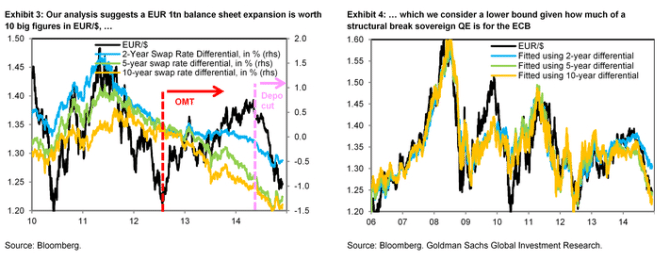

“Our European economists saw ECB President Draghi’s dovish speech on November 21 as signalling sovereign QE from the ECB, with a magnitude of at least €500bn (and likely closer to €1tn),” GS projects.

In that regard, given the sharp EUR/USD decline since this speech, some market players now believe that QE is already priced in. GS strongly strongly disagrees.

To make its case, GS discusses a round of analytical approaches, all of which are rough benchmarks and are hardly conclusive, such as the QE experience in the US and its impact on the USD.

“That said, they point to substantial downside for EUR/$ from here (we think at least 10 big figures), in line with our 12-month forecast of 1.15,” GS argues.

“In our minds, sovereign QE is therefore far from priced in and Euro downside remains our strongest conviction. Much of this view rests on the ECB, although this week’s Fed speakers have also been a reminder of the cyclical divergence between the US and the Euro area, which is another factor supporting of our view,” GS adds.

For lots more FX trades from major banks, sign up to eFXplus

By signing up to eFXplus via the link above, you are directly supporting Forex Crunch.