The Reserve Bank of Australia left its interest rates unchanged at 1.5%, as widely expected. However, they seem to have upgraded their rhetoric regarding the strength of the Australian dollar.

The team led by Phillip Lowe stated that a rising A$ would slow down the economy and that it is restraining price measures. They are trying to talk down the Aussie and it is easier to hit it when it’s down.

On other topics, they said that despite strong employment, there has been slow growth in wages. What about housing? They note that conditions are easing in Sydney’s housing market.

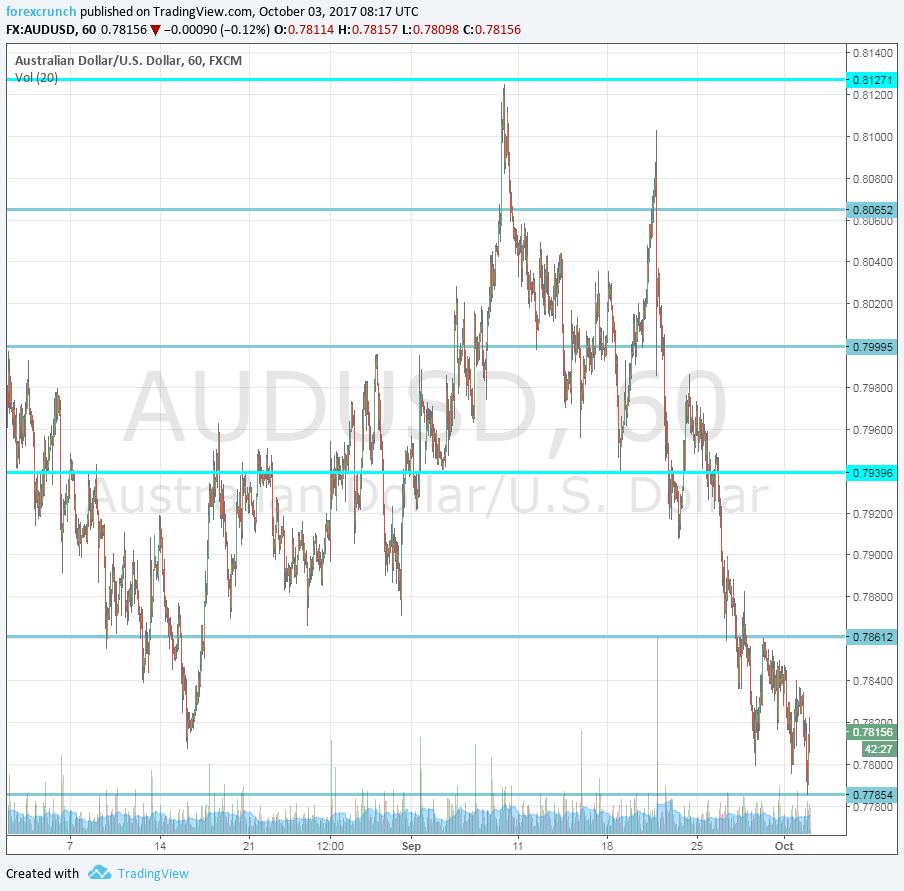

AUD/USD reached a new low of 0.7785, but continues sticking to 0.78, trading around 0.7815 at the time of writing. Further support awaits at 0.7715, if 0.7785 is breached. The next lines are 0.7635 and 0.7565. Resistance awaits at 0.7860 and 0.7940.

The drop in AUD/USD is also related to the US dollar’s strength. The greenback continues rising. Yesterday, it got a boost from an upbeat number on the ISM Manufacturing PMI.

Here is the hourly chart.