The Reserve Bank of Australia left its policy unchanged once again and sounded somewhat upbeat. The new governor of the RBA seems a bit more hawkish than his predecessor. The Aussie was also helped by good Chinese data.

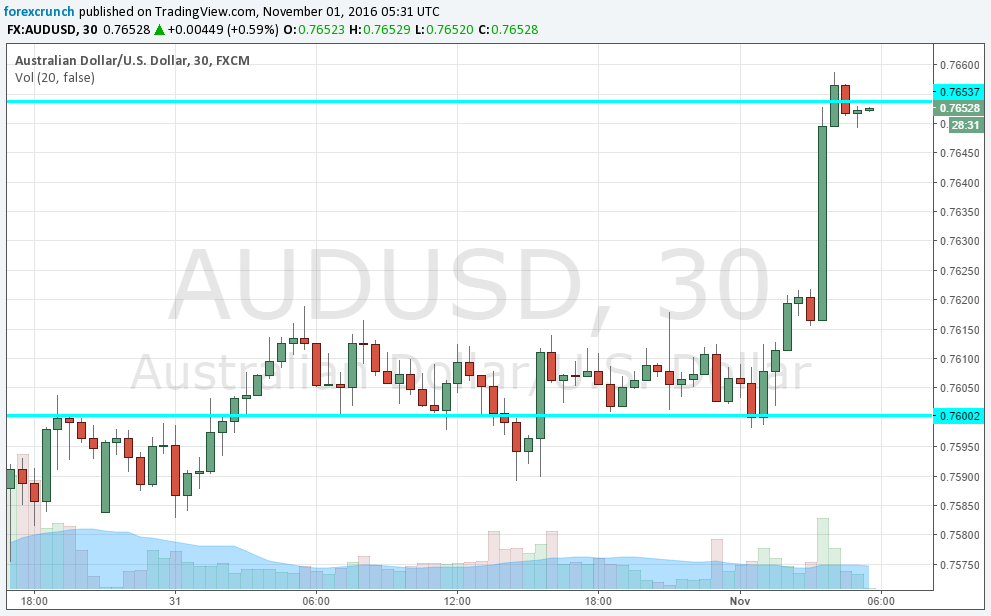

AUD/USD made a move higher worth some 50 pips and trades around 0.7650.

Lowe not too worried about AUD

Here is a key paragraph about inflation and the Bank’s policy from the statement. They see a stronger exchange rate as something that could “complicate” matters, but not as a big issue.

Low interest rates have been supporting domestic demand and the lower exchange rate since 2013 has been helping the traded sector. Financial institutions are in a position to lend for worthwhile purposes. These factors are assisting the economy to make the necessary adjustments, though an appreciating exchange rate could complicate this.

The RBA cut rates earlier this year but is not keen to make the next step beyond the current rate of 1.50%. Here is a reminder, from the last paragraph:

Taking account of the available information, and having eased monetary policy at its May and August meetings, the Board judged that holding the stance of policy unchanged at this meeting would be consistent with sustainable growth in the economy and achieving the inflation target over time.

Pickup in Chinese manufacturing

This is the first day of the month and purchasing managers’ indices are flowing out of China. The independent Caixin manufacturing PMI jumped from 50.1 to 51.2, showing that growth has picked up. This implies more demand for Australian commodities.

In addition, the official PMIs were upbeat: the manufacturing one also hit 51.2 points while the services PMI ticked up from 53.7 to 54. China’s transition from manufacturing and investment to consumption and services is advancing, albeit it a slow pace.

AUD/USD rises

AUD/USD trades around 0.7650, up from “hugging” the 0.7650 level. Further resistance awaits at 0.7740, followed by the cycle high of 0.7840. Support is at 0.7530 and 0.75.

More: AUD: Only A Buy Vs NZD – SocGen