- Cryptocurrencies are in the red after a week of gains.

- Bitcoin is taking a break and Ethereum is in deep trouble.

- But Ripple is well supported and may be ready for the next move up.

After a week of rises, digital coins are struggling again. A natural correction is normal after a hectic week that saw significant gains. But where does a normal drop end and a new downfall begin?

The Confluence Indicator helps us answer the question.

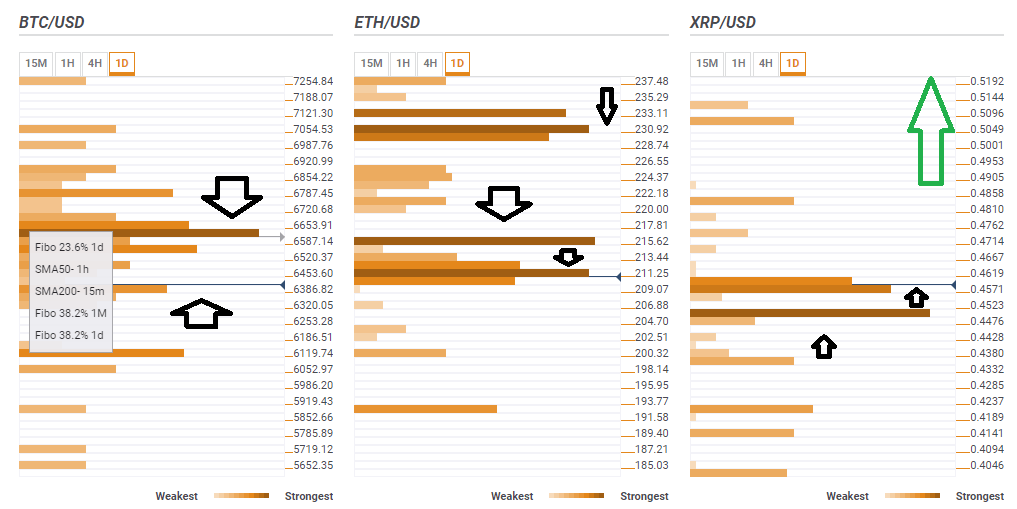

For Bitcoin, we see that it has some support at $6,386 where we see the convergence of the following technical lines: the Pivot Point one-day Support 3, the Fibonacci 61.8% one-week, the 4h low, and the Bolinger Band 15m Lower.

For the BTC/USD to resume its rises, it must surpass the $6,600 area where we see a congestion that includes the Fibonacci 23.6% one-day, the Simple Moving Average 50-one-hour, the SMA 200-15m, the Fibonacci 38.2% one-month, and the Fibonacci 38.2% one-day.

Ethereum is in deep trouble. It first needs to convincingly overcome $211 where we see the Simple Moving Average one-hour, the Pivot Point one-month Support 1, and the 15m high. Close by, an even stronger cap awaits. $215 is the confluence of the BB one-day Middle, the Fibonacci 61.8% one-week, and the SMA 50-15m.

It doesn’t end there: $230 is the meeting point of the Fibonacci 23.6% one-day, the SMA 10-4h, and the Fibonacci 38.2%.

On the other hand, Ripple enjoys favorable conditions. It is well supported at $0.4571 where we see the PP one-day S1, the SMA 10-1h, and the 4h high coverage. Further support is at $0.45. It is the confluence of the PP one-month R1, the SMA 15m, and the BB 4h-Lower and 15-Middle.

Looking up, the XRP/USD has no noteworthy limits at least until $0.52.

See the Crypto Confluences Indicator live