Idea of the Day

Risk appetite has been building in recent weeks with the dollar index declining and this morning it looks like a similar pattern is being played out. The Chinese data overnight has given the dollar bears the upper hand and so we are seeing the Aussie head higher taking it to the 0.9150 area.

This week is likely to be remembered for the move in sterling which has seen the bears of the British pound rather caught off guard following Mark Carney’s first BOE Inflation Report as the new governor, where he was seen almost to be playing up sterling and upward revisions to the UK’s growth prospects have seen cable make some decent ground taking it above the 1.5500 mark. Today’s calendar is quite quiet and in the absence of any major data releases history suggests we may drift in the direction of the current trends.

Data/Event Risks

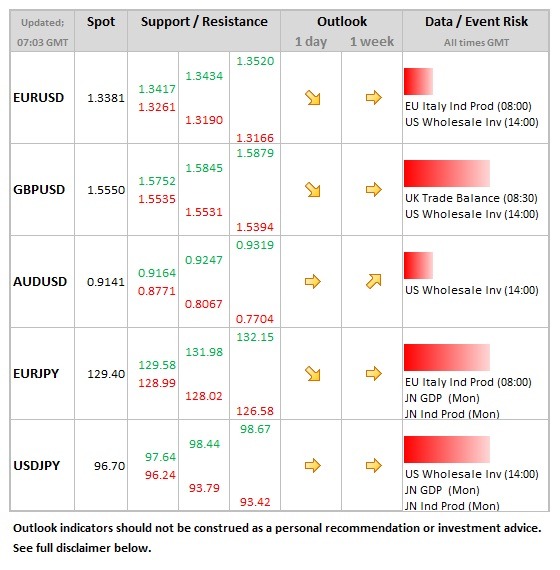

GBP: UK trade balance figures are released this morning and whilst they are not seen as a major market mover, any surprise to the upside in terms of exports could lead to a continuation of the support that sterling has received in recent days.

USD: Inventory data from the US is expected to show a rise in the value of goods held in stock by wholesalers. A higher than expected figure could play into the hands of the dollar bears who look to remain in control at the moment.

Latest FX News

JPY: Dollar woes continued as the yen strengthened yet further taking it to just below the 96.00 level. A flat session overnight for the Nikkei has allowed USDJPY to recover a little ground to 96.50 following weaker than expected consumer confidence figures.

AUD: Chinese industrial production data this morning has complimented yesterday’s strong import and export data and has helped support the Aussie’s move to the upside helping it to recapture the 0.9100 level.

EUR: Unemployment in Greece remains rampant with the rate rising to 27.6% which was higher than expectations of a decline to 26.9% from 27.0%. There are concerns that following the German election next month that Greece will be back in the spotlight which could cause considerable volatility in the Autumn.

Further reading: EUR/USD Advances to Major 1.3400 Resistance