Summary:

- ECB’s tapering decision is expected in the coming months

- Will the ECB risk making changes ahead of the German elections later this month?

- Market reaction to the ECB meeting outcome

One might get tiresome of hearing the same thing over and over again. But it still warrants another repetition.

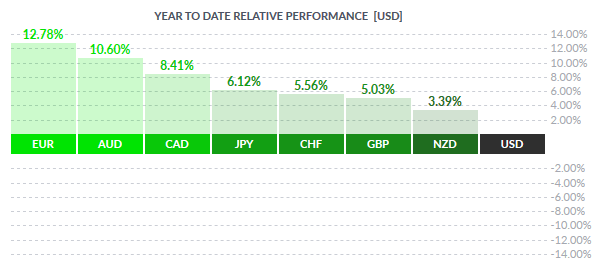

The euro is the top performing currency this year.

From an underdog, with forecasts talking about EURUSD parity, the common currency proved most analysts wrong. On a year to date basis, as of Friday’s close, September 1st the common currency has gained 12.78% against the U.S. dollar.

EURUSD YTD Performance (Source: Finviz.com)

The rapid appreciation in the exchange rate was underlined by consistent economic performance and a modest yet steady increase in consumer prices.

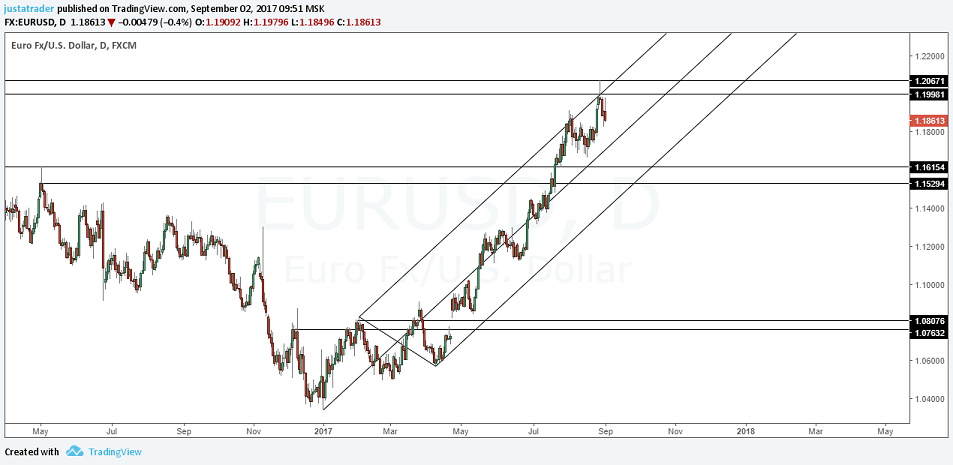

As investors look to this week’s ECB meeting, the stakes are high. Last week’s price action suggests that some cautious profit taking already took place as the EURUSD surged to fill the gap at 1.20 from 2014. Briefly surging higher to 1.2070, the common currency pulled back at a familiar resistance level.

So, what’s in store as the ECB meeting is coming up this Thursday?

Tapering will come, but the question is when!

It is all about the timing! The ECB’s governing council signaled many times in the past that it would not rush to cut back on its QE purchases, citing the risks of premature tightening.

The markets rallied ever since Draghi said “We can be confident that our policy is working and its full effects on inflation will gradually materialize. But for that, our policy needs to be persistent, and we need to be prudent in how we adjust its parameters to improving economic conditions.”

Investors however strongly hung on to Draghi’s comments on the economy. “All the signs now point to a strengthening and broadening recovery in the euro area.” This comment was more than enough for the markets to bid up the euro higher.

At the time of making the comments in Sintra, Portugal, the EURUSD closed at 1.1132. By Friday, September 2, the euro closed at 1.1861, marking a 6.5% rally in under three months.

What the markets missed, however, was the fact that although the ECB is optimistic and acknowledged the recovery in the eurozone, it is still cautious. While investors are expecting some form of QE tapering from the ECB, it is unlikely that the central bank will announce its tapering plans this week.

Will the German elections this month play a role in the ECB’s decision?

Although the German elections loom on the horizon, it would be a bit too pessimistic to suggest that the German elections will influence the ECB’s decision. Let’s face it! Germany has been a staunch believer of a stronger exchange rate. German officials have always made this quite vocal at various instances.

Unlike other previous elections held in the Eurozone this year, the odds of the anti-establishment and euro-skeptic parties making strong inroads into the German Bundestag are much less. The markets broadly see the German elections as a non-event as the odds build for the incumbent Angela Merkel to win another term with a comfortable margin.

While Germany prefers a stronger exchange rate, it is likely to impact other economies in the eurozone which are just getting warmed up.

In August, the ECB minutes cautioned that there was a “risk of the euro overshooting.” A stronger exchange rate will no doubt impact Germany’s export sector while at the same time posing a serious threat to inflation which is still far away from the ECB’s 2% inflation target rate.

How will the euro react to the ECB’s outcome? – A technical perspective

While news wires cheered the EURUSD’s brief stint to 1.2067 last week, this rally culminated with a bearish close by end of the week. This reversal also coincides not just with the unfilled gap at 1.209 from January 2nd, 2015; the region also marked a multi-year test of support at 1.2067 from July 25, 2017.

With price action suggesting a strong reversal here, we can expect the common currency to potentially slip towards the next support at 1.1615 – 1.1529. While there is scope for EURUSD to trade sideways in this range, further declines cannot be ruled out in the medium term.

Of course, a break out within the ranges of 1.206 and 1.1529 will determine the next leg in the EURUSD.

In conclusion, this week’s ECB meeting could potentially prepare the markets for the next step the ECB will take. It will be interesting to see how the markets interpret comments from the central bank.