EUR/USD is fluctuating around the 1.10 level, up from the lows but not going anywhere fast.

What’s next for the pair? The team at Barclays explains why a short on euro/dollar remains the key trade:

Here is their view, courtesy of eFXnews:

In a recent note to clients, Barclays Capital explains why short EUR/USD remains their flagship trade recommendation and still their favored way to express USD strength. The following are the key points in Barclays’ note along with the details of its current open short EUR/USD position.

1- “Several factors explain what happened in EURUSD in recent months and underscore our optimism for what awaits the cross in the months ahead. Why did the EURUSD downtrend take a break? How high is our conviction on another selling leg? Are we still expecting EURUSD to trade at 0.95 one year out with the same conviction?,” Barcalys notes.

2- “Our answers explain why selling EURUSD remains our flagship recommendation, at least for now. The longer-than-anticipated break in the USD uptrend has been driven in part by the bund rates sell-off that began in April, which we did not expect, supporting the EUR against the USD. Much has been written on the drivers of this rate sell-off, and the jury is still out as to whether this was the beginning of a trend or a one-off correction driven in part by liquidity. We are inclined toward the latter view and have a high conviction that it is too early for the ECB to be comfortable with further sell-offs from current levels,” Barclays argues.

3- “Thus, we view this as a good entry level into reinitiating short EURUSD positions, as we recommended in May. While we see risks that US rates may not be pricing enough tightening and that bunds may be pricing too much, our conviction in a lower EURUSD is also supported by what is currently priced in forward rates,” Barclays advises.

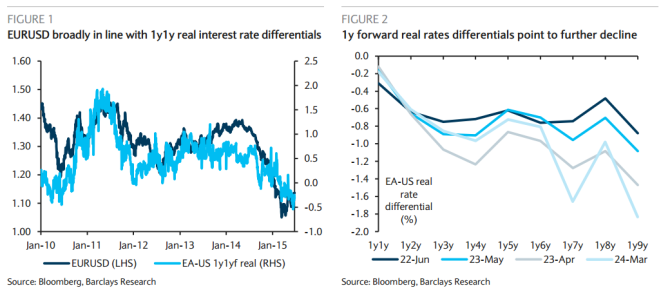

4- “Figure 1 shows that EURUSD is broadly fair given current 1y1y real interest rate differentials. Figure 2 shows that current 1-year euro area-US forward real rate spreads suggest further downside pressures on EURUSD ahead. The one-year-forward real rate differential is priced to drop another 60bp in two years, according to market rates (we think it will drop even more), adding further selling pressure on EURUSD,” Barclays adds.

5- “We think the policy divergence theme remains firmly in place. Although we believe the bund sell-off increases EUR sensitivity to euro area uncertainty, we see a short EURUSD position as among the best to hold. We continue to expect EURUSD to trade through parity in early 2016,” Barclays projects.

In line with this view, Barclays maintain a short EUR/USD position from 1.1240, with a stop at 1.1680, and a target at 1.0460.

For lots more FX trades from major banks, sign up to eFXplus

By signing up to eFXplus via the link above, you are directly supporting Forex Crunch.