Nobody expected a contraction of 2.9% in Q1. A second downward revision was certainly expected, but this kind of shrink was a shocker. But that was Q1 and we are close to the end of Q2, so durable goods orders for May, the previous month, were in the limelight. Yet also here, the picture looks gloomy.

The result was a crash of the US dollar. However, for three currency pairs, a certain core aspect of durable goods orders prevented a breakout of ranges in three pairs: EUR/USD, GBP/USD and USD/CAD:

Taking orders of durable goods and excluding defense and and air-related orders, we get a minor positive surprise: a rise of 0.7% instead of 0.5%. Core numbers filter out the most volatile components and tend to see the underlying economic trends. As the data is for the middle of the second quarter and not for the first quarter, this may have been enough for the three pairs.

See the charts with an explanation below each one of them.

EUR/USD

The pair traded for a long time in the 1.3585 to 1.3650 range and suffered from weak European data. The news sent it from 1.3615 all the way to… 1.3650, where it stopped.

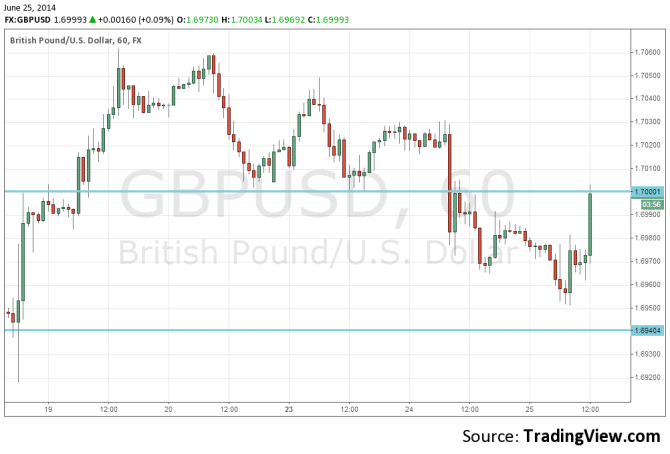

GBP/USD

It took cable a long time to break above 1.70, but recent comments from the BOE sent it below the line. The news from the US sent the pair higher, to flirt with 1.70, but that was it. No convincing breakout was recorded.

USD/CAD

The Canadian dollar has been on a roll since the positive Canadian data on Friday. After the big downwards move of USD/CAD, the pair settled in a convenient range of 1.0715 to 1.0750. The news sent it down from 1.0750 to 1.0720, 5 pips above support. But there it stopped.

The focus now shifts to the Core PCE Index, especially after Yellen put the emphasis on this number for inflation.