- XAG/USD is ticking up as the Fed adds 2.3 trillion in loans.

- The level to beat for buyers is the 15.50 resistance.

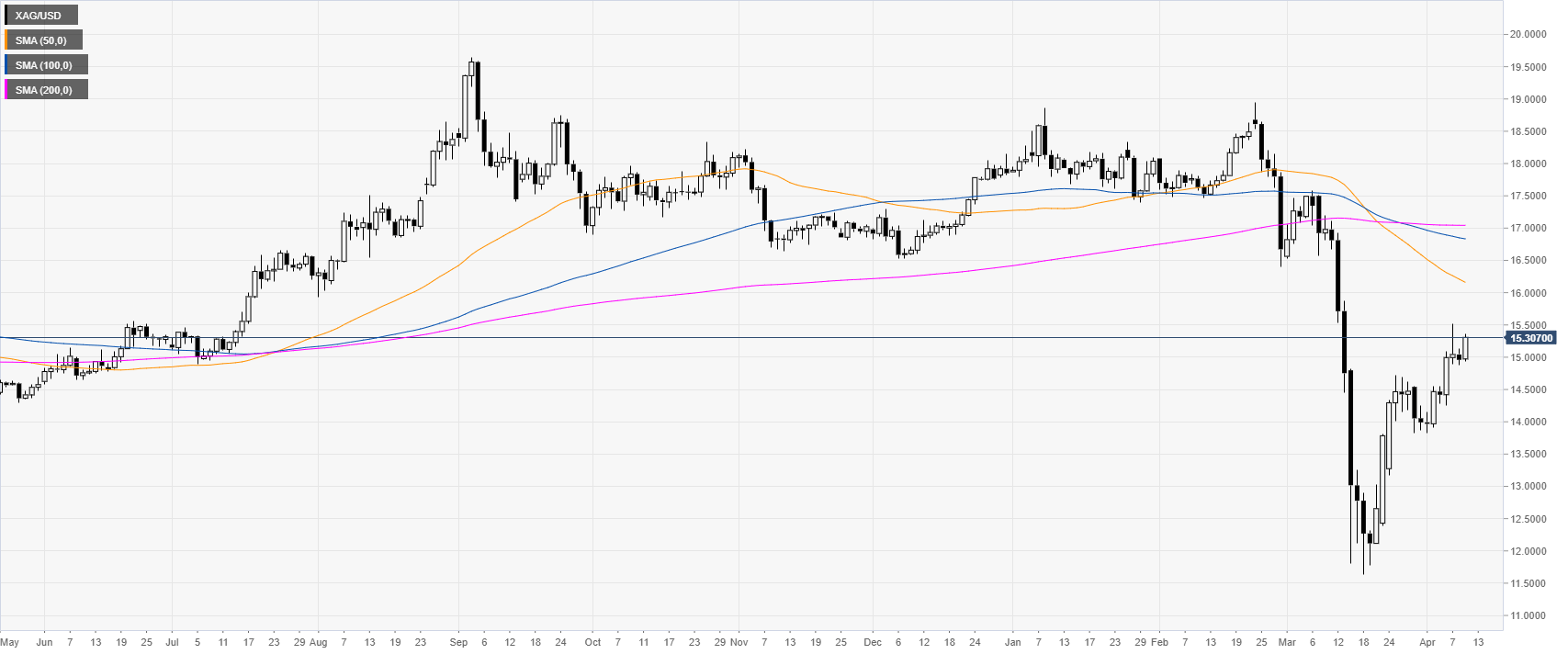

Silver daily chart

After the sharp drop to 2009 lows, XAG/USD is bouncing up as the Fed introduced a limitless Quantitative Easing (QE) in order to respond to the coronavirus crisis. In addition to this, the Fed announced this Thursday that it was going to inject $2.3 trillion in additional loans while US jobless claims are above 6.6 million, which was worse than anticipated.

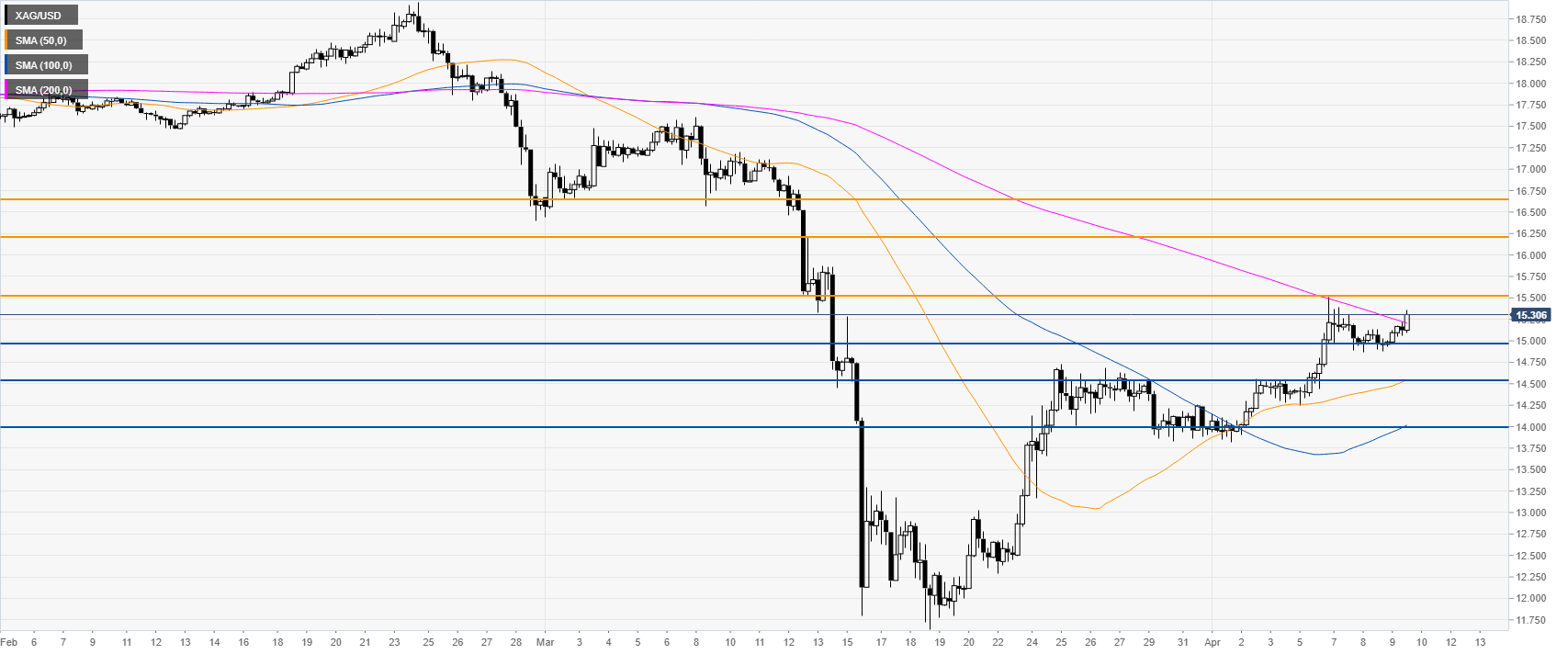

Silver four-hour chart

Silver is trading above the 15.00 level and the 200 SMA on the four-hour chart as buyers are looking to extend the bullish uptick towards the 16.20 and 16.60 levels. Support could emerge near the 15.00, 14.50 and 14.00 price levels on any retracements.

Resistance: 15.50, 16.20, 16.60

Support: 15.00, 14.50, 14.00

Additional key levels