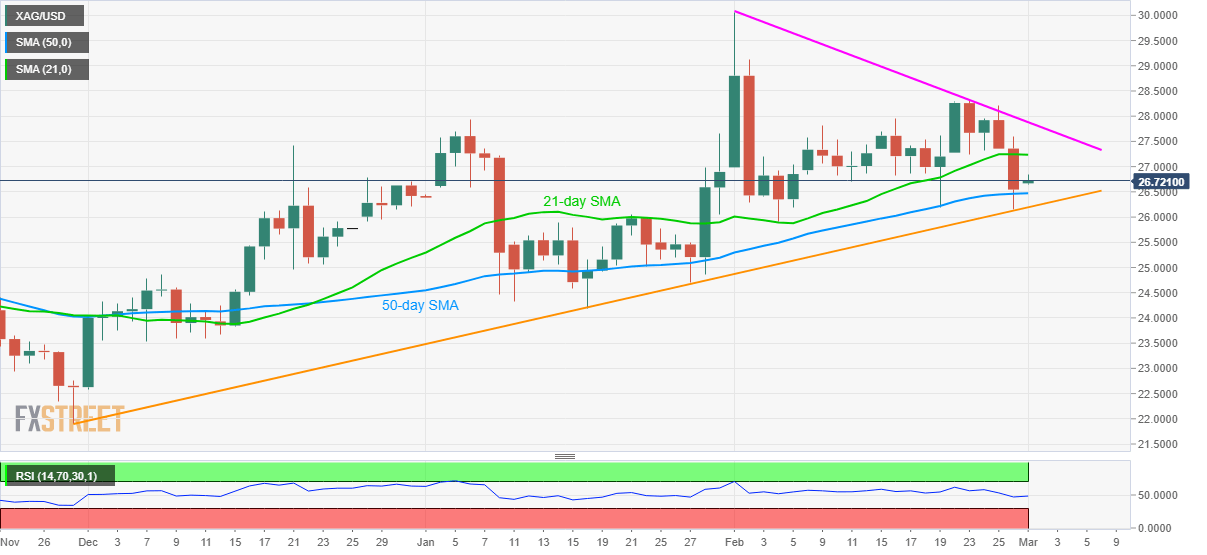

- Silver eases from intraday top while also snapping a two-day downtrend.

- Normal RSI, corrective pullback from key support line direct buyers toward 21-day SMA.

- 50-day SMA offers immediate support, monthly resistance line adds to the upside filter.

Silver prices waver around $26.80, up 0.90% intraday, during Monday’s Asian session. In doing so, the white metal keeps the bounce off an ascending trend line from November 30 despite recent easing from $26.85.

Given the absence of overbought/oversold RSI conditions, coupled with the quote’s latest U-turn from the key support line, silver prices are likely to remain directed towards a 21-day SMA level of $27.25.

During the rise, the $27.00 round-figure may offer an intermediate halt whereas a descending trend line from February 01, at $27.90 now, can question any further upside.

Alternatively, a downside break of 21-day SMA, currently around $26.50, will fetch the bullion back to the stated support line near $26.20.

While the break of a multi-day-old key support will direct the metal bears towards the yearly bottom near $24.20, the $26.00 and the $25.00 thresholds can act as buffers.

Overall, silver is comparatively stronger than gold due to its industrial usage amid the hopes of economic recovery.

Silver daily chart

Trend: Bullish