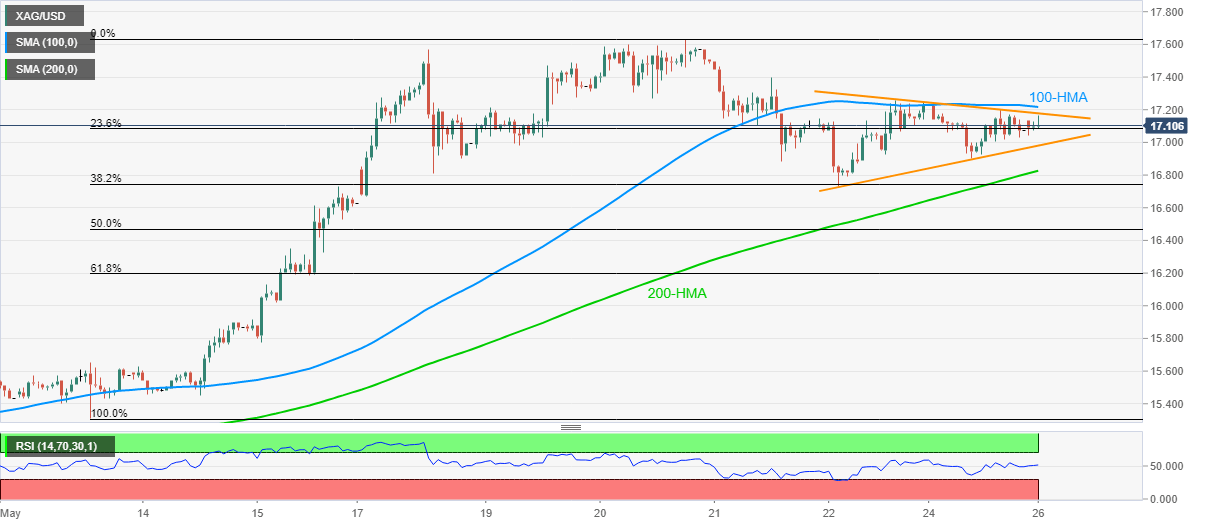

- Silver extends latest pullback from $16.90, keeps two-day triangle formation intact.

- 100 and 200 HMAs offer extra filters to predict the bullion’s move.

- RSI conditions keep suggesting gradual recoveries towards the monthly top.

Silver prices take the bids near $17.16, up 0.53% on a day, during the initial Tokyo session on Tuesday.

Despite recovering from $16,73 on Friday, the white metal portrays a short-term symmetrical triangle that limits its current moves between $16.98 and $17.18 levels respectively.

Also adding to the trading barriers will be 100 and 200-HMAs near $17.22 and $16.83 in that order.

The quote declines below $16.83 may await validation from Friday’s low of $16.73 before targeting 61.8% Fibonacci retracement of its May 13-20 upside, at $16.20.

On the contrary, a sustained break above $17.22 will find it difficult to cross the monthly high surrounding $17.63, a break of which could quickly cross $18.00 round-figure.

Silver hourly chart

Trend: Sideways to positive