- Silver stays mildly bid inside a choppy range between $22.58 and $22.68.

- Nearly oversold RSI conditions can help bullish candlestick in portraying recovery moves.

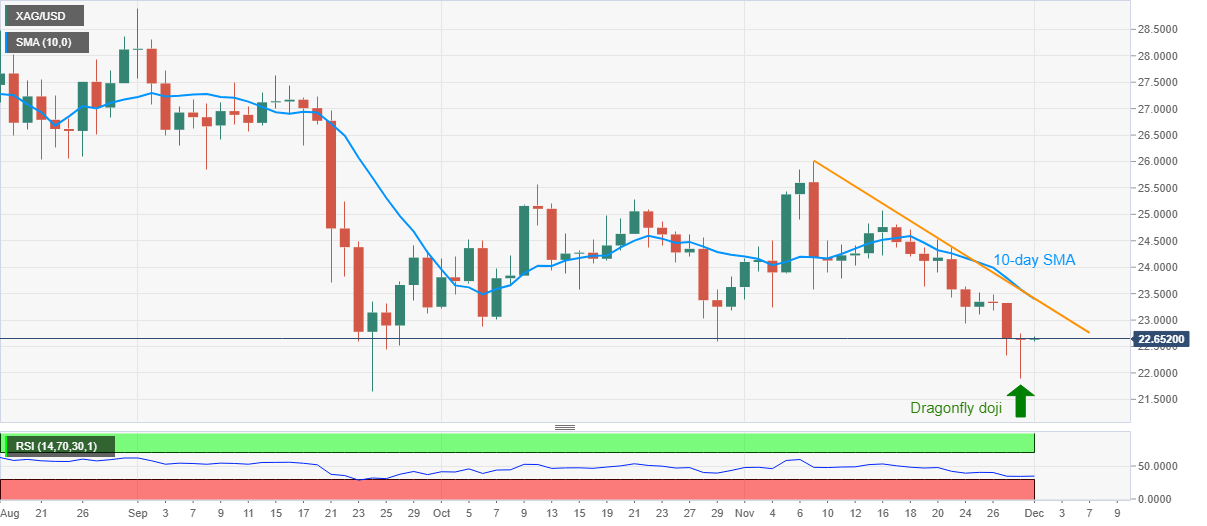

- A confluence of 10-day SMA, three-week-old falling trend line offers a strong upside barrier.

Silver prices take rounds to $22.68, up 0.12% intraday, during Tuesday’s Asian session. The White metal dropped to the fresh low since September 24 the previous day before bouncing off $21.89.

With that, Monday’s daily candle turns out to be a dragonfly doji, bullish candlestick, which also gains support from a nearly oversold RSI line, currently around 34.00.

As a result, the commodity’s further pullback towards the $23.00 threshold can’t be ruled out. However, a 10-day SMA and a descending resistance line from November 09, currently around $23.40, will restrict the quote’s further upside.

It should also be noted that the silver bulls’ dominance past-$23.40 can probe the mid-November high near $25.10.

On the flip side, the $22.00 round-figure and the recent low around $21.90 may entertain the sellers ahead of directing them to September’s low of $21.65.

However, the metal’s further weakness below $21.65 will make it vulnerable towards revisiting the $20.00 psychological magnet and February high near $19.00.

Silver daily chart

Trend: Pullback expected