- XAG/USD smashes through the support structure to test 10-DMA.

- There were no holders of massive silver short positions.

As per the Chart of the Week, where it was stated, ”all can come crashing down as fast as it went up”, the price of silver has indeed crashed and bulls have thrown in the towel.

Silver has lost around 12.8% in the move from the highs with the bulk of the supply kicking in around the European open.

Daily chart

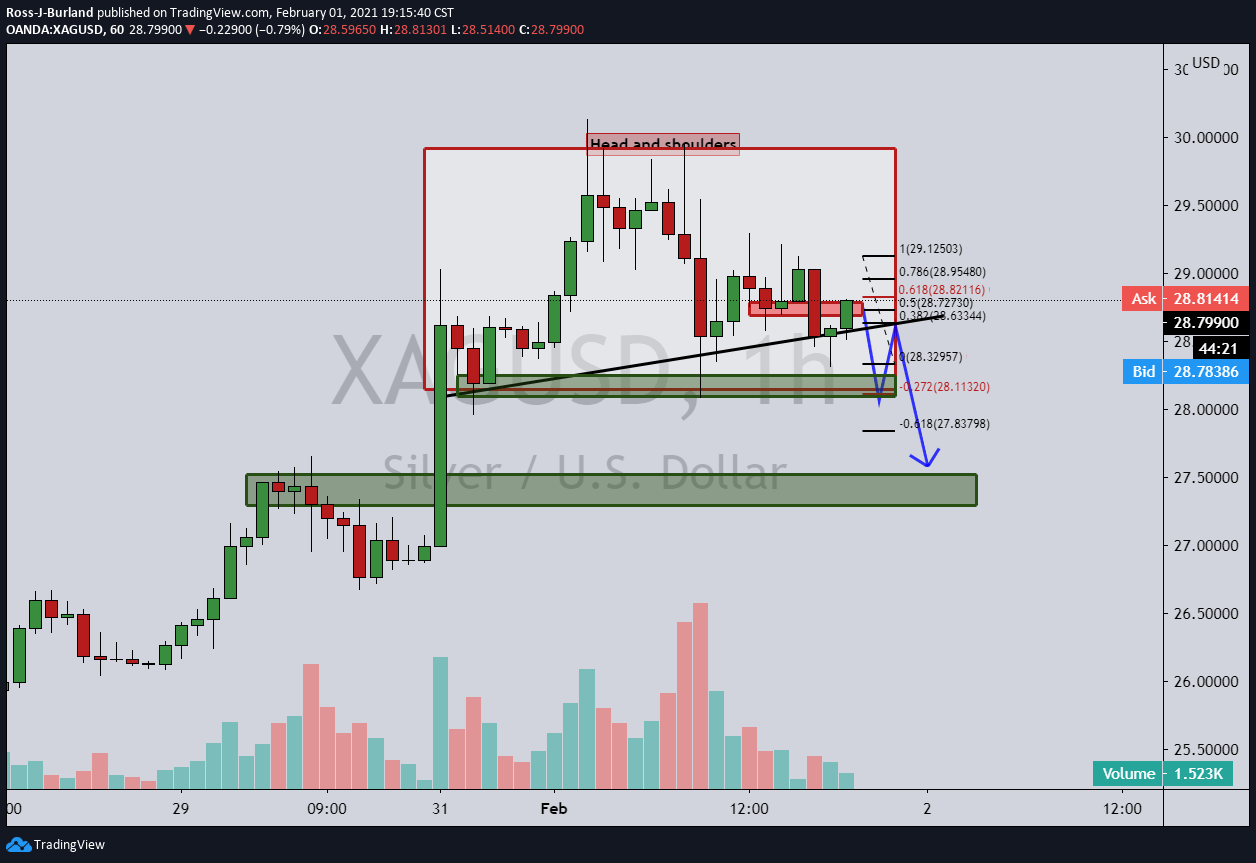

In subsequent analysis, before the crash occurred, Silver Price Analysis: Bears eyeing a break of hourly supports to $27.50, it was noted that XAG/USD was on the verge of a break of the H&S neckline:

The risk was projected to $27.50 while below $29.50.

Live market

As illustrated, the price reached the expected support which held initially before buyers thought twice about holding on before bailing the sinking ship.

US yields shot higher as some normalisation returned to markets following the Reddit frenzy and the US dollar picked up a strong bid.

It’s like trying to drain the ocean

Silver is a far more liquid asset for the likes of amateur trading forums to be able to take on convincingly, especially against a market that is already tilted long.

There were evidently fewer shorts to squeeze than anticipated, with Comex silver positioning suggesting only a small contingent of traders short.

Silver is not a stock where prices can easily be manipulated if there is a big enough positioning one way or the other for retail forums to squeeze.

The silver metal is traded to the tune of around half a billion ounces each day in the London Over-The-Counter,(OTC), market.

It is true that US bullion-trading banks have large short positions in silver futures, but these tend to be balanced against long positions in the London OTC market which makes it impossible to drain enough liquidity to send price to the moon.

Nonetheless, that is not to say we will not see silver reemerge from this sell-off.

Volatility is typical in the silver market and has a habit of shaking out the weak hands, or in this case, the Reddit bid.

However, the Reddit movement has likely brought even more awareness to the soundly traditional fundamentals and qualities of the asset as an investment.

This, therefore, may have been the next catalyst for a bullish continuation in the trend.

-637478864893944591.png)

-637478871146386534.png)

-637478892299975582.png)