- Silver prices waver around two-week top, stay positive for the fourth consecutive day.

- MACD eases bearish bias, sustained trading above key SMA favor the bulls.

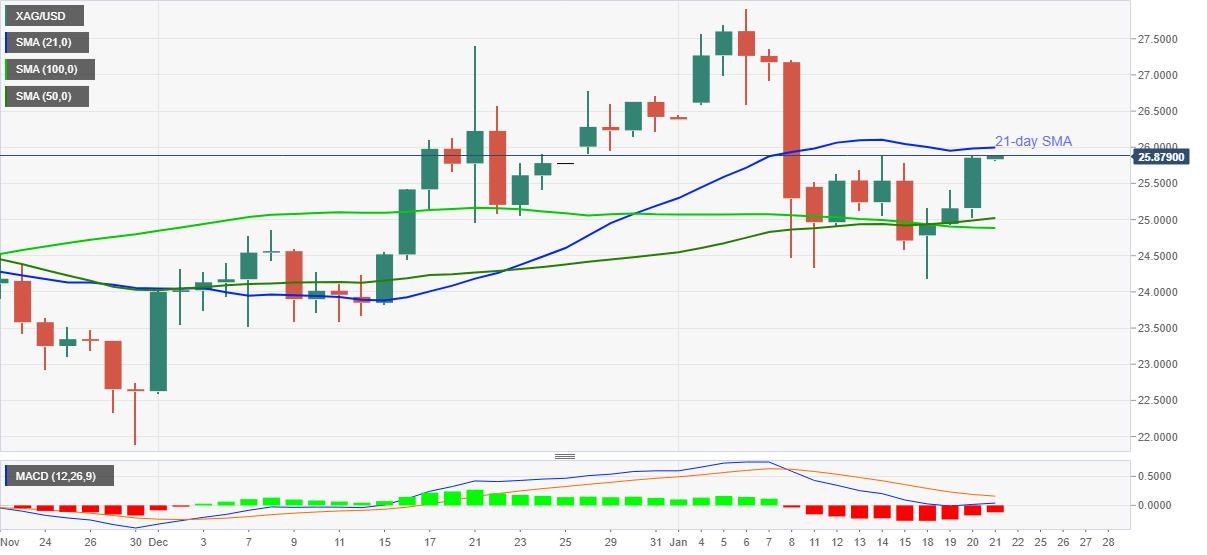

Silver eases to $25.85 during Thursday’s Asian session. Even so, the white metal stays positive around the two-week high, flashed before a few minutes, while marking a four-day uptrend.

Behind the moves are the bullion’s successful trading above 50-day and 100-day SMA and receding strength of the bearish MACD signals.

As a result, silver bulls are currently battling the 21-day SMA level of $26.00 ahead of January 06 low near $26.60.

During the quote’s rise past-$26.60, the $27.00 and the previous month’s high near $27.40 can entertain silver buyers before directing them to the monthly peak surrounding $27.95 and the $28.00 threshold.

Meanwhile, the metal’s pullback moves need to provide a daily closing below 50-day and 100-day SMA confluence between $24.88 and $25.00 to recall the sellers.

Following that, the monthly low near $24.18 and the early December levels near $23.50 will be in the spotlight.

Silver daily chart

Trend: Bullish