- Silver bulls catch a breather around the highest in one week.

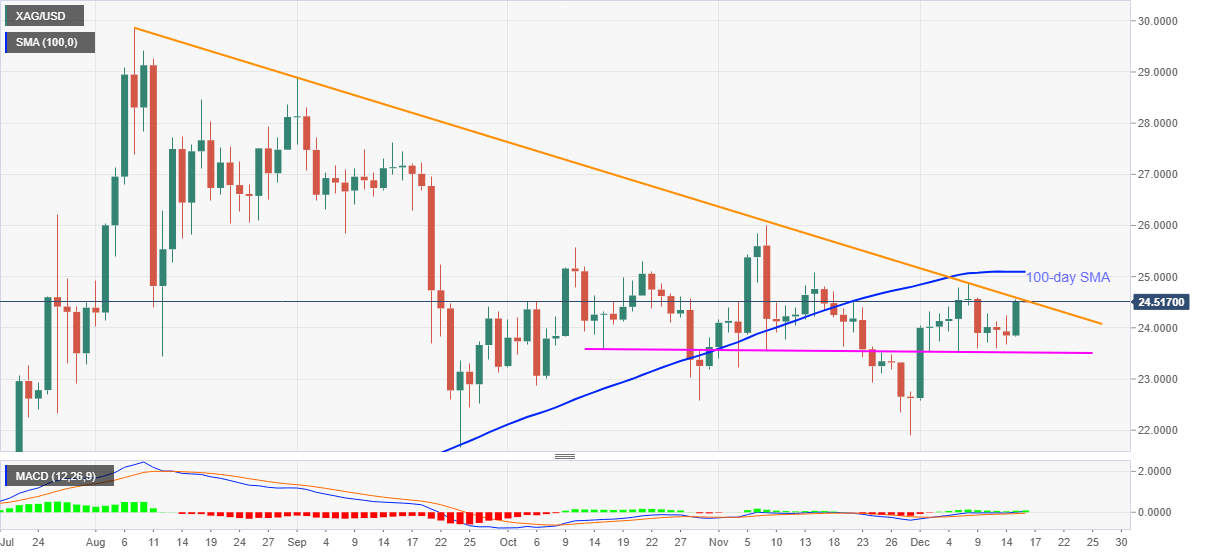

- Four-month-old falling trend line guards immediate upside ahead of 100-day SMA.

- Bullish MACD, sustained trading beyond two-month-old support line favor buyers.

Having marked the biggest gains in over two weeks the previous day, silver takes rounds to $24.50 during the early Asian session on Wednesday. In doing so, the white metal struggles to clear a downward sloping trend line from August 07.

With the upbeat MACD conditions joining the commodity’s readiness to stay above a horizontal support area since mid-October, around $23.52/57, suggests the bullion’s further upside.

However, the 100-day SMA level of $25.10 adds to the upside filters beyond the stated resistance line, currently around $24.53.

In a case where silver prices cross $25.10, November’s top near $26.00 will be the key to watch.

Meanwhile, a downside break below the $23.52/57 support area can recall the metal sellers targeting the $23.00 threshold and October lows near $22.60.

During the quote’s further weakness past-$22.60, the previous month’s low near $21.90 and September’s trough close to $21.65 will lure the bears.

Silver daily chart

Trend: Further upside expected