- Silver fades upside momentum after refreshing the weekly top.

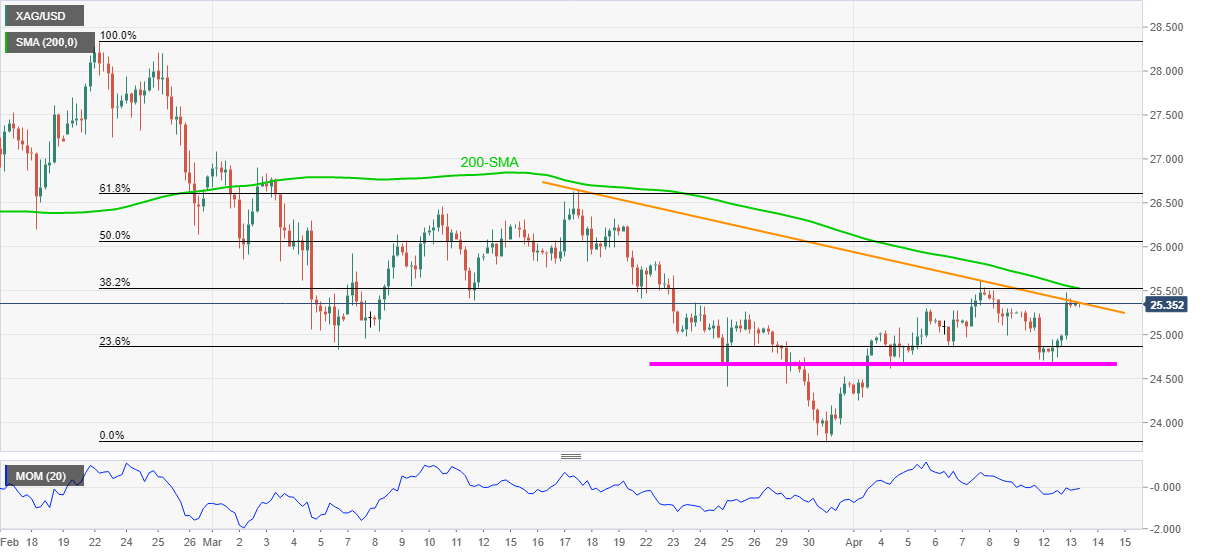

- Confluence of 200-SMA, 38.2% Fibonacci retracement also challenges the bulls.

- Sellers will look for entries below three-week-old horizontal support.

Silver prices waver around $25.30 during Wednesday’s Asian session. In doing so, the white metal buyers confront a downward sloping trend line from March 18 after refreshing the weekly top the previous day.

Although upbeat Momentum favors the quote’s upside break of the stated resistance line, around $25.35, a convergence of 200-SMA and 38.2% Fibonacci retracement level of February 23 to March 31 downside, near $25.52, will be the tough nut to break for the silver bulls.

It should, however, be noted that a clear upside past-$25.52 will propel the quote towards a 61.8% Fibonacci retracement level of $26.60.

Alternatively, pullback moves may aim for the $25.00 threshold whereas 23.6% Fibonacci retracement and a horizontal area comprising multiple lows since March 25, close to $24.65, should restrict the commodity’s further weakness.

In a case where the bullion drops below $24.65, March’s low near $23.77 should gain the market’s attention.

Silver four-hour chart

Trend: Further recovery expected