- Silver eyes deeper losses as the daily technical setup screams sell.

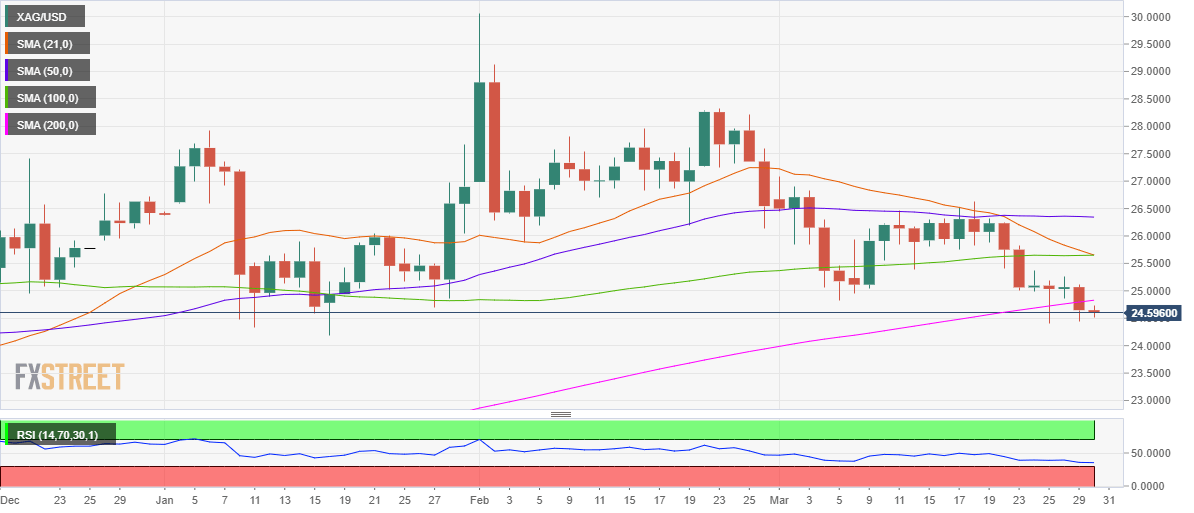

- XAG/USD saw a daily closed below 200-DMA for the first time since May 2020.

- A bear cross and RSI below the midline adds to the bearish outlook.

Silver (XAG/USD) is consolidating Monday’s sell-off below the $25 mark, awaiting a strong catalyst to resume the downside.

Immediate cushion for the white metal is seen at the March 25 low of $24.41, below which the losses could extend towards the $24 psychological magnate.

The downside appears more compelling for silver, especially after the price gave a daily closing below the crucial 200-daily moving average (DMA) at $24.83 for the first time since May 2020.

Adding credence to the bearish bias, a bear cross is confirmed on the said timeframe after the 21-DMA pierced through the horizontal 100-DMA from above.

Further, the 14-day Relative Strength Index lies below the midline, supporting the case for the pessimists.

Silver Price Chart: Daily

Alternatively, acceptance above the 200-DMA support now resistance is needed for the XAG bulls to attempt any recovery.

The next upside target is aligned at Monday’s high of $25.10.

All in all, the path of least resistance appears to the downside for silver.

Silver Additional levels