Silver has been on the foot, falling alongside other precious metals and assets as the US dollar is reasserting its strength in August. Can XAG/USD return to the highs seen in July? The technicals are pointing lower despite fundamental reasons to see higher silver prices.

XAG/USD was pushed higher by the increase in XAU/USD – gold hit record highs, pulling silver with it. Analysts have been pointing out that the increase in silver prices stems also from the European Union’s decision to dedicate more funds to green initiatives – favoring the usage of the precious metal.

Yet at least in the short term, silver could come under pressure.

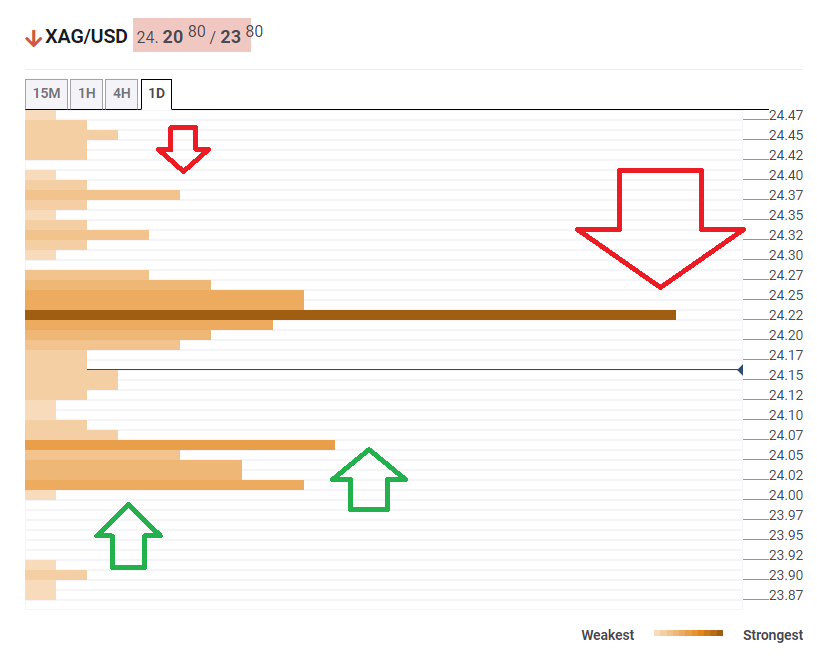

The Technical Confluences Indicator is showing that silver is capped by resistance at $24.22, which is the convergence of the Fibonacci 23.6% one-day, the Fibonacci 23.6% one-week, and the Simple Moving Average 5-one-day.

The next cap is $24.35, which is the meeting point of the SMA 50-4h and the SMA 50-15m.

Support is waiting at $24.06, which is where the SMA 10-4h hits the price.

Further down, the next cushion is at $24, a round number which is also a confluence level where the Fibonacci 38.2% one-day, the Bollinger Band 1h-Lower, and the BB 4h-Middle.

Key XAG/USD resistances and supports

Confluence Detector

The Confluence Detector finds exciting opportunities using Technical Confluences. The TC is a tool to locate and point out those price levels where there is a congestion of indicators, moving averages, Fibonacci levels, Pivot Points, etc. Knowing where these congestion points are located is very useful for the trader, and can be used as a basis for different strategies.

Learn more about Technical Confluence