- Silver opened with a bullish gap and shot to near six-month tops on Monday.

- Slightly overbought conditions warrant some caution for bullish traders.

- The stage still seems set for a move towards testing August 2020 swing highs.

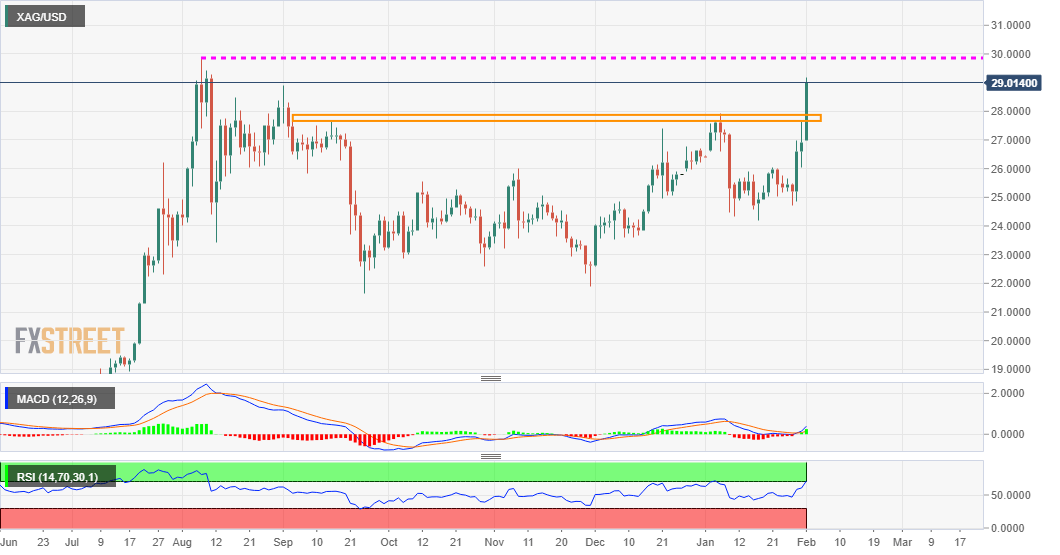

Silver built on the weekly bullish gap opening and jumped to the highest level since August 2020 during the early European session. A sustained strength beyond the $27.80-$28.00 supply zone was seen as a key trigger for bullish traders and pushed the XAG/USD closer to the $29.00 mark.

The ongoing surge was driven by posts on the Reddit platform, urging retail investors to buy silver mining stocks and exchange-traded fund (ETF) backed by physical silver bars. This, in turn, led to a short-squeeze similar to what was seen in GameStop shares during the previous week.

Meanwhile, technical indicators on hourly charts are already flashing overbought conditions. Moreover, RSI on the daily chart has just started moving above the 70.00 mark, warranting some caution for bullish traders and before positioning for any further appreciating move for the XAG/USD.

Hence, bulls might take a brief pause near the $29.10-15 resistance zone. That said, some follow-through buying has the potential to push the white metal further towards August 2020 monthly swing highs resistance, around the $29.80-85 region, en-route the key $30.00 psychological mark.

On the flip side, any meaningful pullback might now find some support near the $28.40-35 region and is closely followed by Asian session lows, around the $28.00-$27.95 region. A further decline might be seen as a buying opportunity and remain limited near the $28.00-$27.80 resistance breakpoint.

XAG/USD daily chart

Technical levels to watch