- Silver picks up bids while trying to defy the previous day’s weakness.

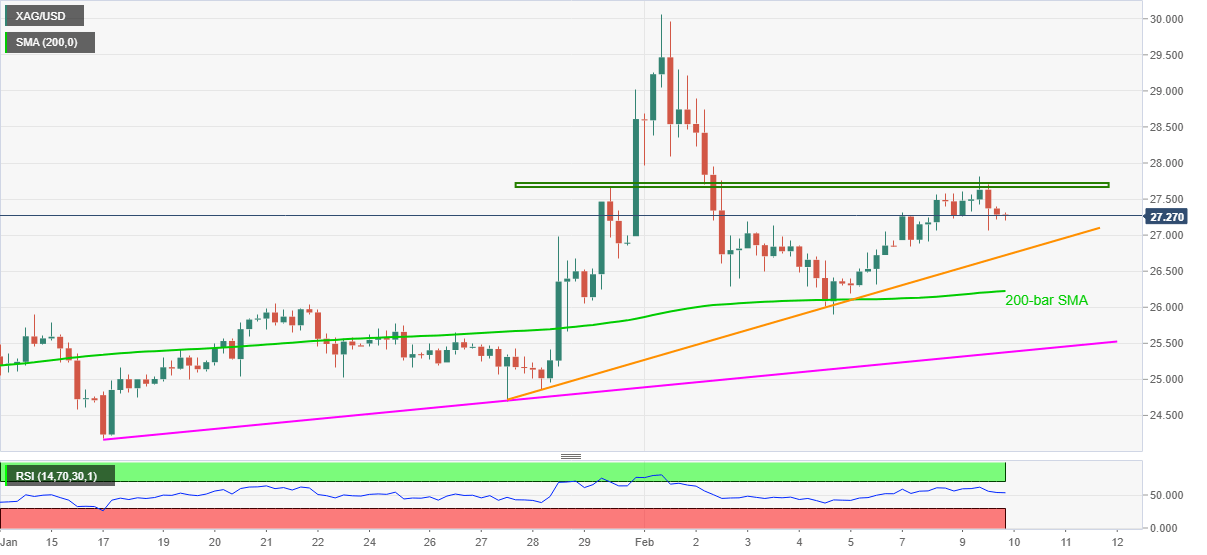

- Eight-day-old horizontal resistance guards immediate upside, 200-bar SMA and monthly support line add to the downside filters.

- Strong, multiple supports raise bars for the bears’ entry.

Silver consolidates recent losses around $27.30 amid Wednesday’s Asian session. The white metal snapped a two-day uptrend the previous day while stepping back from a short-term hurdle.

Although the bullion sellers currently eye an upward sloping trend line from January 27, at $26.72 now, strong RSI conditions suggest a sustained upside momentum.

In addition to the immediate support line, 200-bar SMA and an upward sloping trend line from January 17, respectively near $26.20 and $25.35, also challenge the silver sellers.

Alternatively, an upside clearance of $27.75 will negate the latest bearish signs and direct the commodity towards the $28.00 threshold.

During its further upside beyond $28.00, the monthly top of $30.06 will lure bulls.

To sum up, silver remains in an upward trajectory despite the latest signals favoring consolidation.

Silver daily chart

Trend: Pullback expected