- Silver is falling for the second straight day on Tuesday.

- Additional losses toward $25 are likely if $25.40 support fails to hold.

- Initial resistance for XAG/USD is located around $25.80.

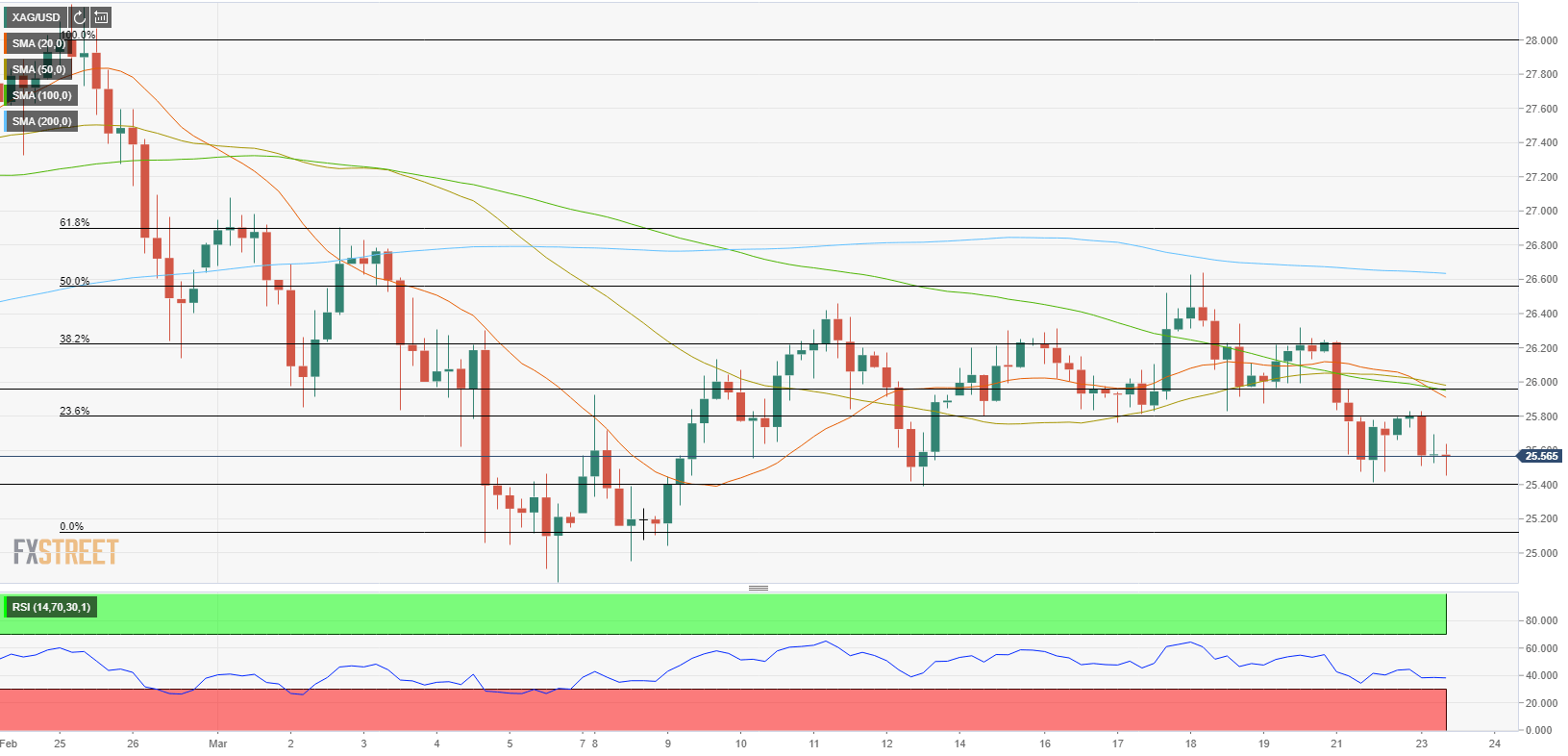

The XAG/USD pair lost nearly 2% on Monday and touched its lowest level in ten days at $25.41 before closing at $25.75. With the greenback starting to gather strength on Tuesday, the pair extended its slide and fell to a daily low of $25.45 but managed to stage a modest recovery. As of writing, XAG/USD was down 0.7% on the day at $25.58.

Silver technical outlook

Until Monday, silver has been fluctuating in a horizontal range between $26.50 and $26 and the latest movements suggests that the price broke below that range. Additionally, the Relative Strength Index (RSI) indicator on the one-day chart stays around 40, confirming the near-term bearish outlook.

On the downside, the initial support is located at $25.40 (daily low, static level). If a four-hour candle manages to close below that level, XAG/USD could aim for $25 (psychological level).

Resistances, on the other hand, are located at $25.80 (Fibonacci 23.6% retracement of Feb. 25 – Mar. 5 decline) and $26 (psychological level, former support, 20, 50, 100-period SMAs). As long as the latter hurdle remains intact, sellers are likely to look to remain in control of silver’s action.

Additional levels to watch for