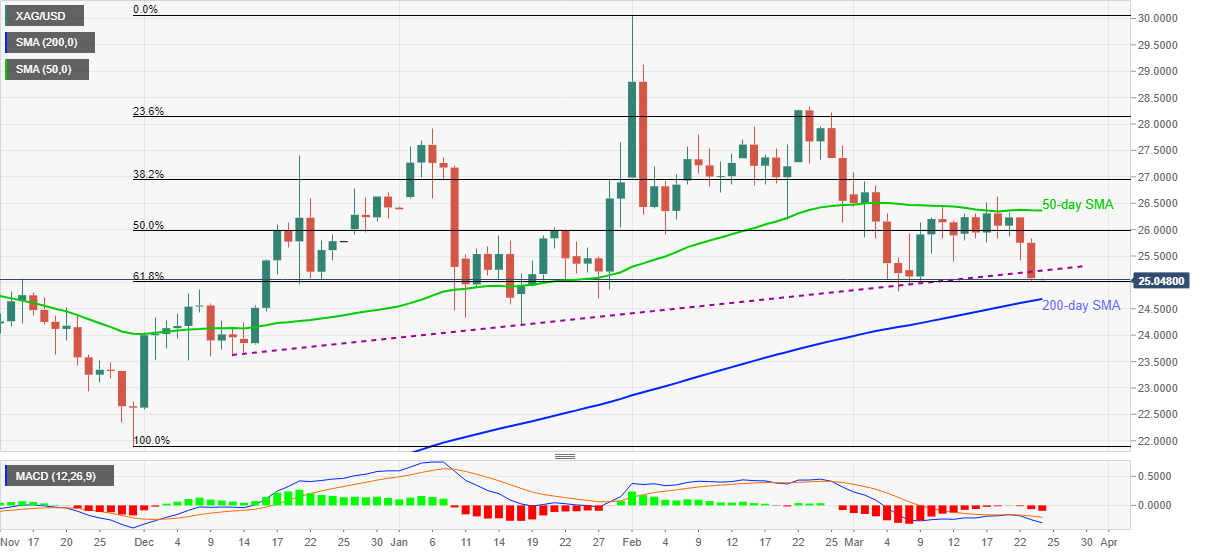

- Silver wavers around two-week low after the heaviest drop since March 04.

- Bearish MACD, sustained break of key trend line favor sellers.

- Bulls seek clearance of 50-day SMA for fresh entries.

Silver sellers catch a breather around $25.00, after declining the most in three weeks, during the early Asian session on Wednesday.

Although 61.8% Fibonacci retracement of November 2020 to February 2021 upside restricts the while metal’s immediate downside, a clear break below the previously crucial support line, now resistance, stretched from December 11, 2020, join bearish MACD to favor sellers.

Hence, fresh selling will wait for a downside break of 61.8% Fibonacci retracement level of $25.00, which in turn will eye the 200-day SMA level of $24.68.

It should, however, be noted that the commodity’s downside break of $24.68 will direct bears toward refreshing the yearly bottom of $24.18 while highlighting the $24.00 threshold.

Meanwhile, corrective pullback beyond the previous support line, at $25.21 now, should challenge the 50% Fibonacci retracement level of $25.98. Though, any further upside will be tamed by the 50-day SMA level of $26.36.

Overall, silver bears the burden of trend line breakdown and bearish MACD to keep sellers hopeful. However, immediate Fibonacci retracement test further downside.

Silver daily chart

Trend: Bearish