- Silver struggles to extend the latest bounce off $26.82.

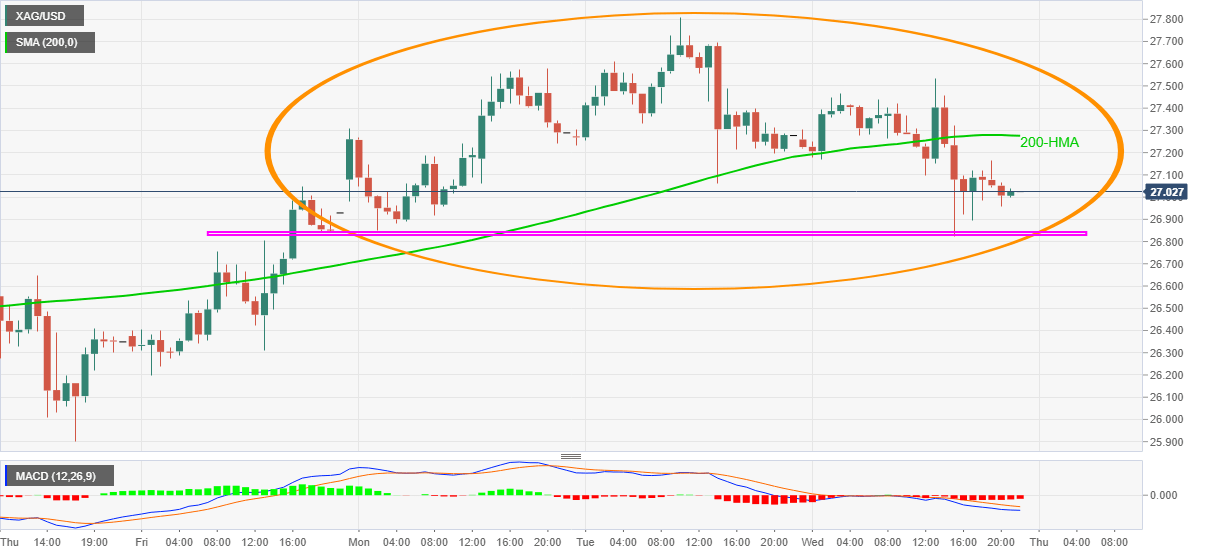

- Sustained downside break of 200-HMA, downbeat MACD and bearish chart formation favor sellers.

- $26.80 offered multiple U-turns off-late, holds the key to monthly low.

Silver prices remain depressed around $27.00 as Asian traders embrace for Thursday’s session. The white metal dropped for the second consecutive day by the end of Wednesday while forming a bearish chart pattern called rounding top on the hourly (1H) formation.

Not only the bearish chart formation but MACD signals and the commodity’s sustained trading below 200-HMA also favors the silver sellers. However, multiple rejections to the bears by $26.80 need attention from traders.

As a result, silver bears should wait for a clear downside break of $26.80 while targeting the monthly low of $25.90. During the declines, the $26.40 level can offer an intermediate halt.

It should, however, be noted that the bullion’s sustained weakness below $25.90 will highlight an ascending trend line from November 30, 2020, currently around $25.30, as the key support.

Meanwhile, $27.45-50 guards the quote’s immediate upside ahead of Tuesday’s top near $27.80.

Also acting as the key resistances are January high near $27.95 and the monthly peak surrounding $30.00.

Silver hourly chart

Trend: Further weakness expected