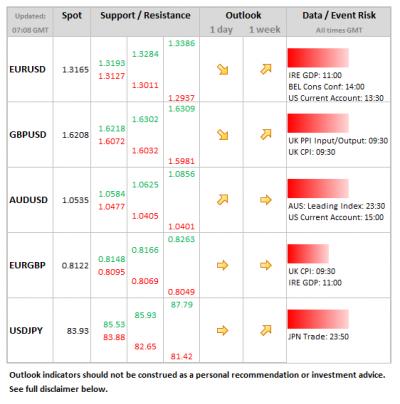

- EUR: Little due for release other than Irish GDP late morning. Traders focused away from the single currency (for a change), absorbed by Japan/the yen, and the fiscal cliff. Ifo tomorrow. Euro still looking solid.

- USD: Fiscal cliff is the only real game in town right now – some encouraging signs are emerging, but there is still a long way to go. USD in a holding pattern while negotiations continue.

- GBP: Inflation data today, followed by MPC Minutes and CBI Sales tomorrow. Cable sitting pretty above 1.62, and looking OK.

Idea of the Day

After reaching a 20mth high of 84.48 yesterday, USD/JPY retreated to 83.60 at one stage in a classic buy-the-rumour/sell-the-fact trade. That said, there were plenty of buyers lining up at lower levels, supporting the idea that yen weakness is actually a structural trade rather than merely something more opportunistic. The BoJ start a two-day meeting tomorrow and it has been put on notice by new PM Abe to get those printing presses moving. Also, LDP is arranging a fresh supplementary budget. No need to fight the price action just yet – there is plenty of potential for more yen-selling in coming weeks.

Latest FX News

- USD: Gradual progress in fiscal cliff talks, with Obama offering to extend tax cuts past year-end for incomes up to USD 400K (Boehner had originally offered USD 1m), agreeing to alter the inflation measure to calculate social security, and offering to raise the debt limit for two years. Still quite some way to go though – disagreements remain in a number of other areas such as taxes on dividends and capital gains.

- EUR: Marked time against the dollar, but experienced some serious profit-taking against the yen. EUR/JPY fell more than 1% from the peak of 111.32, just failing to crack the March 21st high of 111.44. Is this failure important? Does it signal that the short yen trade has now run out of puff?

- AUD: Firmed slightly yesterday after looking a little soggy early on. Still looks to have a respectable underlying bid. RBA Minutes suggested that decision to cut rates was 50/50.