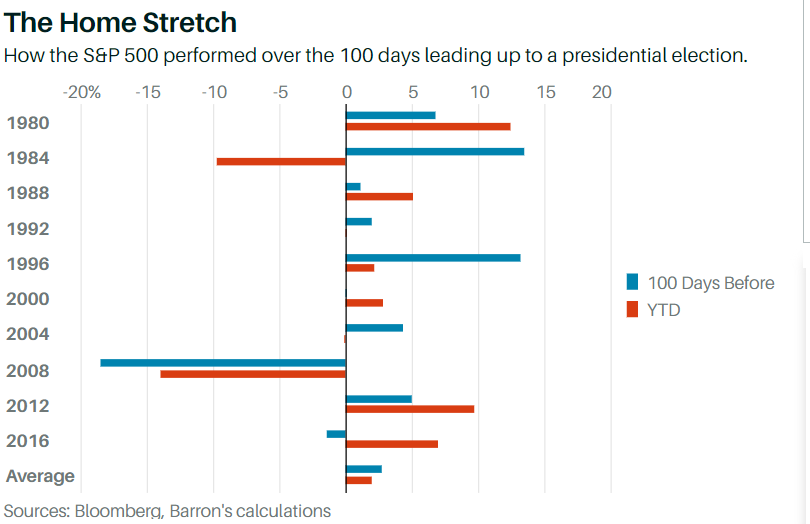

With less than 100 days left to the 2020 US Presidential elections, let’s take a look at the S&P 500 index, as per Barron’s study of pre-election performance.

Key quotes

“Vice President Joe Biden appears to have an edge over Trump in recent polls. But polls don’t always predict outcomes and sentiment can change on a dime.

If 40 years of history is any guide, markets should continue to rise and could be less volatile.

To get a better sense of how markets performed before a presidential election, Barron’s looked at the S&P 500’s performance in the 100 days leading up to election days dating back to 1980, finding that the index rose 80% of the time. During late summer and early fall months, the S&P 500 sees gains 60% of the time in nonpresidential election years.

Volatility tended to drop in the 100 days leading up to the election, too. For example, in 2012 and 2016, the most recent elections, stock market volatility ticked down in the election cycle’s final days, compared with the 100 days beforehand, even as campaign rhetoric—particularly in 2016—intensified.

In 2008, then-senators Barack Obama and John McCain campaigned during the early part of the last financial crisis when markets swiftly tumbled and there were fears that the banking system could collapse.

The S&P was much more volatile in the 100 days coming into the final stretch of that election. What’s more, it fell 18.5%, compared with a roughly 14% year-to-date drop before the 100 days before election day.”