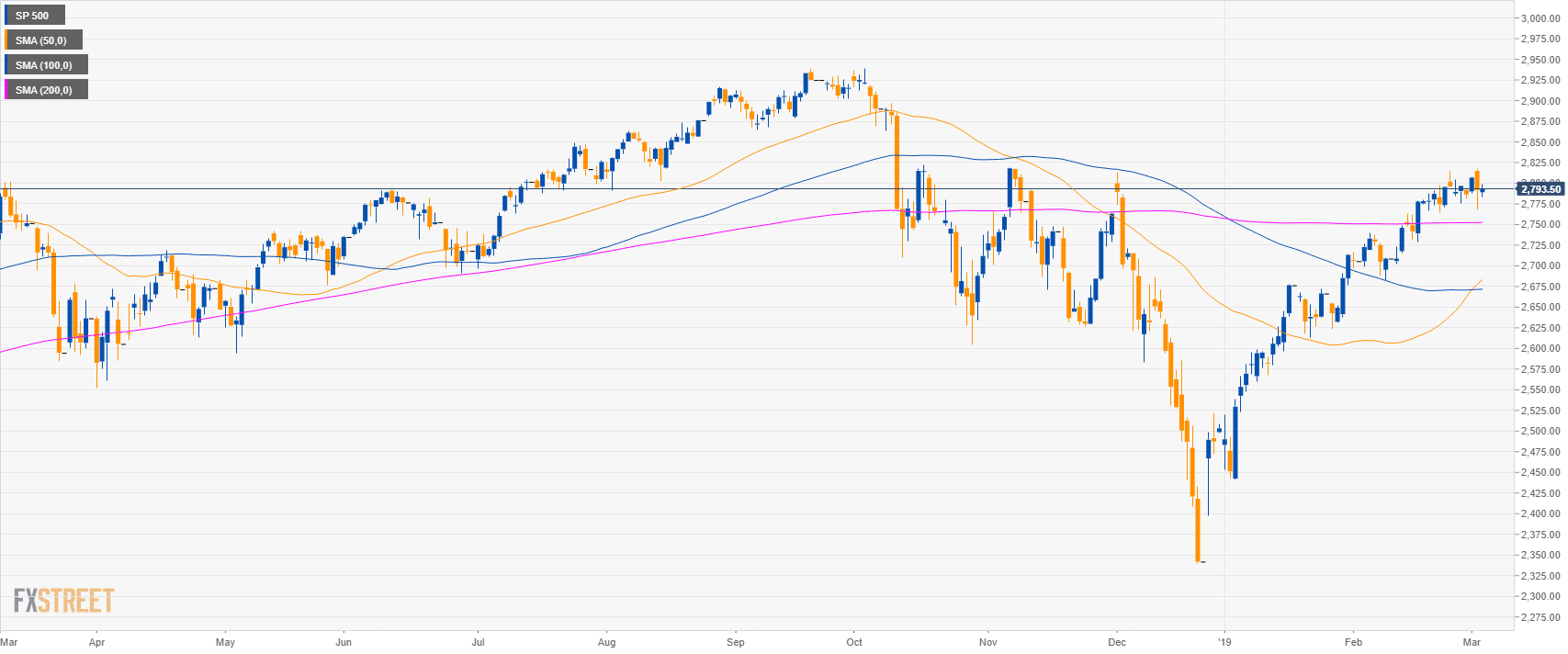

S&P500 daily chart

- The S&P500 is trading in a bull leg above the 200-day simple moving averages (SMA).

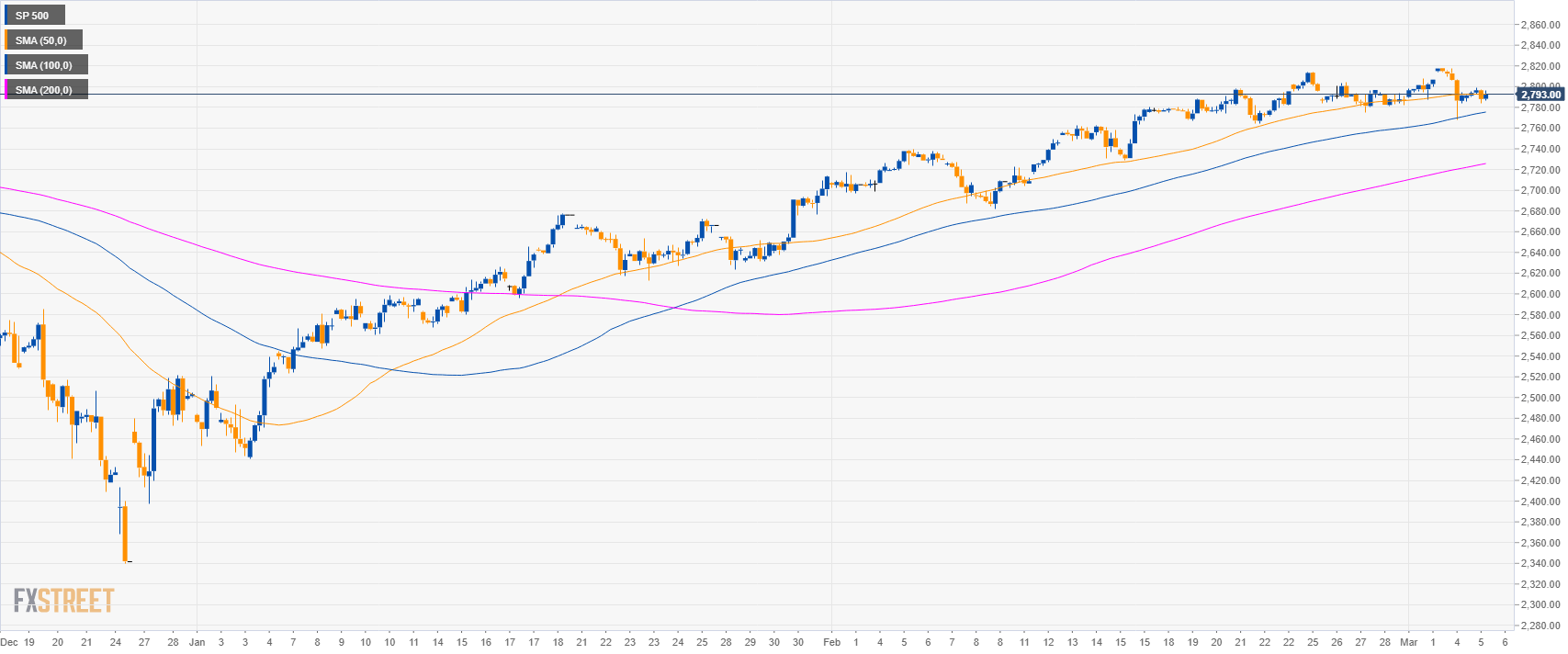

S&P500 4-hour chart

- The market is trading above its 100 and 200 SMA however below its 50 SMA, suggesting a potential pullback down.

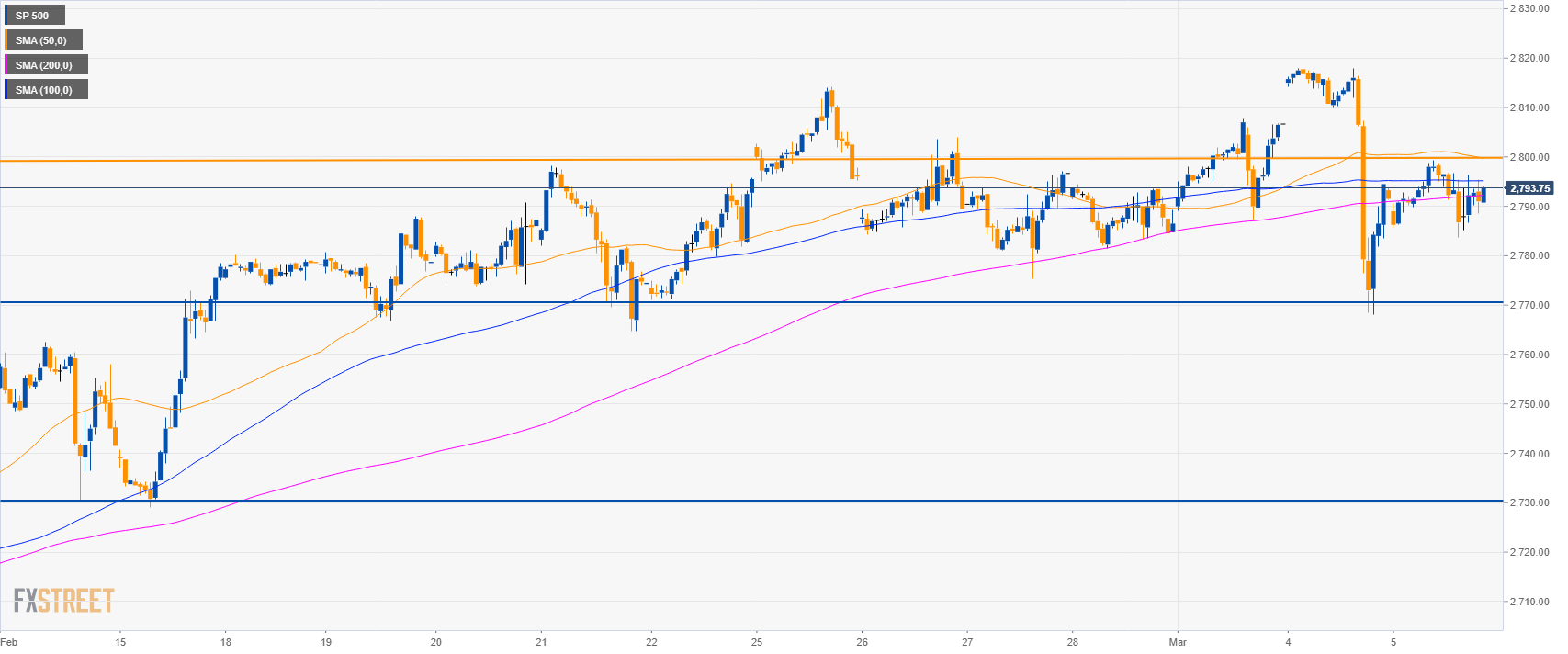

S&P500 60-minute chart

- The S&P500 is trading below its main SMAs suggesting bearish momentum.

- Resistance is at the 2,800.00 level.

- Bears will likely target 2,770.00 to the downside and 2,730.00 level in the medium-term.

Additional key levels

SP 500

Overview:

Today Last Price: 2792

Today Daily change: 50 pips

Today Daily change %: 0.02%

Today Daily Open: 2791.5

Trends:

Daily SMA20: 2762.85

Daily SMA50: 2677.35

Daily SMA100: 2671.38

Daily SMA200: 2752.41

Levels:

Previous Daily High: 2818

Previous Daily Low: 2768

Previous Weekly High: 2814.25

Previous Weekly Low: 2775.25

Previous Monthly High: 2814.25

Previous Monthly Low: 2681.75

Daily Fibonacci 38.2%: 2787.1

Daily Fibonacci 61.8%: 2798.9

Daily Pivot Point S1: 2767

Daily Pivot Point S2: 2742.5

Daily Pivot Point S3: 2717

Daily Pivot Point R1: 2817

Daily Pivot Point R2: 2842.5

Daily Pivot Point R3: 2867