Dollar/yen has been on the back foot due to the weakness of the US dollar and the Fed’s more dovish tone regarding rate hikes. Nevertheless, the team at Bank of America Merrill Lynch see the bullish trend intact.

They also see interesting patterns in EUR/GBP:

Here is their view, courtesy of eFXnews:

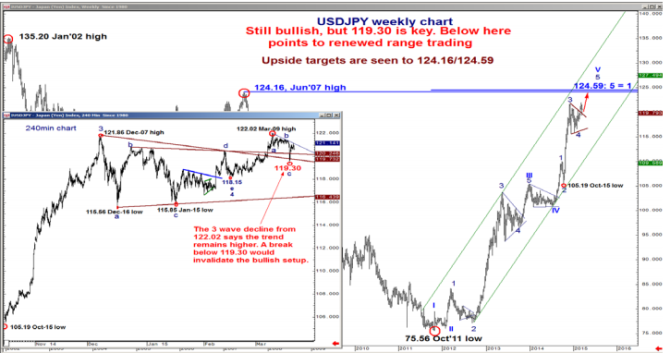

USD/JPY decline from the Mar-09 high of 122.02 to the Mar-18 low 119.30 unfolded in a classic, corrective 3-wave decline, notes Bank of America Merrill Lynch.

“This behavior is indicative of a counter trend move and says stay bullish. A break of 121.14, trendline resistance, confirms a return to trend, targeting 124.16/124.59,” BofA projects.

Meanwhile, BofA notes that EUR/GBP continues its stair-step advance.

“While we are very leery of the fact that the cross has completed its correction higher (the 0.7294 high off Mar18 completed a “zig-zag pattern), we have zero interest in fighting the tape,” BofA advsies.

“Indeed, until we see an impulsive break of 0.7174/0.7166, the upward correction remains intact for a move toward 0.7405/ 0.7429, before renewed topping,” BofA projects.

For lots more FX trades from major banks, sign up to eFXplus

By signing up to eFXplus via the link above, you are directly supporting Forex Crunch.