EUR/USD had its lowest weekly close since 2012 at the end of last week, below 1.24. Can we expect a correction now or is another leg down on the world’s most popular pair?

The team at Barclays suggests staying short and provide some nice charts:

Here is their view, courtesy of eFXnews:

Investors following tactical strategies should consider staying short EUR/USD and selling any bounces this week, advises Barclays Capital in its weekly FX pick to clients.

“Dovish comments from ECB President Draghi suggest that the ECB is getting closer to QE. Given our medium-term bearish view on EURUSD, we prefer selling EURUSD on any rallies,” Barclays advises.

“Given the generally dismal euro area outlook, we continue to highlight that the ECB will have to do more to re-invigorate inflation, and we expect them to commence EGB purchases as early as Q1 2015. As we highlighted in FX Themes: EUR: Black Diamond slope, we continue to forecast significant EUR depreciation, as poor relative returns to capital discourage EUR ownership,” Barclays adds.

In terms of this week’s data, Barclays expects this week’s euro area inflation data to re-affirm the need for further easing measures.

“We expect euro area inflation (Friday) to remain unchanged at 0.4% y/y (consensus: 0.4% y/y) and look for an unchanged reading in core inflation (Friday) at 0.7% y/y (consensus: 0.7% y/y) as well,” Barclays projects.

“Given our expectations for a virtually unchanged inflation path in the coming months before increasing only slowly thereafter, we see risks of further declines in short-to-medium term inflation expectations, supportive of our bearish EUR view,” Barclays adds.

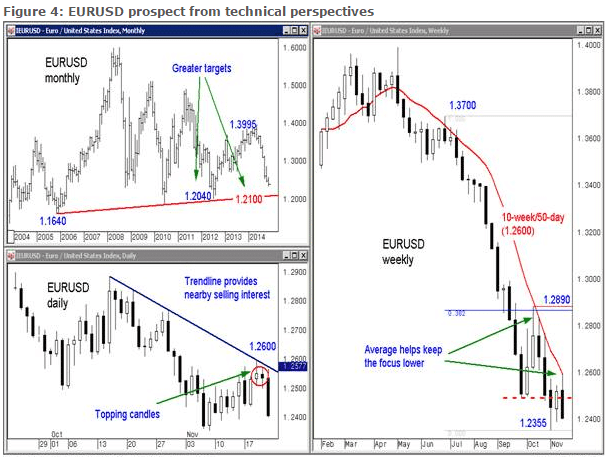

On the technical front, Barclays technical strategist notes that bearish EURUSD view is encouraged by the recent sell-off against a cluster of resistance in the 1.2600 area.

“The 50-day average has reliably capped upticks in price over the past six months, and nearby trendline resistance provides additional reason to sell. We look for a break below the 1.2355 area to confirm extension of the greater bearish trend towards our next targets in the 1.2100 area and then the 1.2040 range lows over the coming weeks,” Barclays projects.

For lots more FX trades from major banks, sign up to eFXplus

By signing up to eFXplus via the link above, you are directly supporting Forex Crunch.