The ECB’s QE announcement and the Greek elections are behind us. The euro has fallen quite a bit so far this month.

Yet also for the last week of January, the team at Barclays sees further room to the downside. Here are the explanations and the chart:

Here is their view, courtesy of eFXnews:

Currency investors should consider staying short EUR/USD this week, advises Barclays Capital in its weekly FX pick to clients.

The trade is macro-technical driven. On the macro front, Barclay’s rationale is as follows:

“We expect the Fed to make few changes to the policy statement on Wednesday and maintain their baseline case of gradual policy normalization starting around mid-2015. This will highlight the contrast with ECB’s dovish policy stance and likely provide additional boost for the USD against EUR,” Barclays projects.

“There is a busy week ahead with the FOMC rate decision (Wednesday) and a series of key cyclical activity data such as durable goods, new home sales, consumer confidence (all on Tuesday) and Q4 GDP (Friday). While inflation and wage data have surprised to the downside lately, they are likely to look through one-month of soft numbers and we expect them to maintain the existing policy stance with few changes to the statement, signaling to the market that their baseline case of gradual policy normalization, around mid-2015 or later, remains intact,” Barclays clarifies.

“On the data front, Q4 GDP will be the highlight and we expect another solid outcome as suggested by ISM, looking for 3.5% q/q (consensus: 3.1%). For others, we expect goods orders ex-transportation of 1.5% m/m (consensus: 0.6%), new home sales of 442K (consensus: 450K) and consumer confidence of 96.0 (consensus: 95.0). Overall solid economic data and confirmation of the Fed’s policy stance would support USD, especially against those currencies with low yields and accommodative policy stance such as EUR and JPY,” Barclays adds.

On the EUR data front, Barclays is slightly below consensus in expecting HICP inflation to have declined to -0.6% y/y in January from -0.2% previously (consensus: -0.5%), while being in line with the market in forecasting core inflation to have remained unchanged at 0.7% y/y.

“Underpinning our forecast, we expect German preliminary consumer prices to have declined to -0.3% y/y from +0.1% previously (consensus: -0.2%; Thursday) and Spanish HICP inflation to have fallen to -1.5% y/y from -1.1% previously (consensus: -1.5%; Friday). However, EUR reaction to any downside surprises may be more muted relative to history as market participants continue to assess the likely impact of the ECB’s recent expanded asset purchase programme,” Barclays projects.

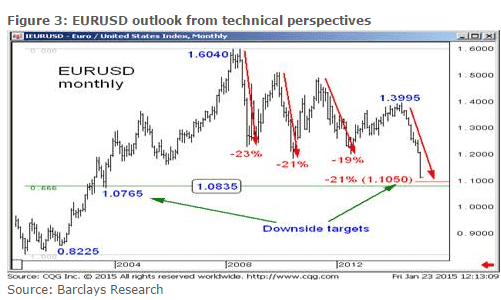

On the technical front, Barclays’ rationale is as follows:

“Given that the declines off major peaks since 2008 have averaged 21%, we are looking for further downside towards 1.1050 initially (marking a 21% decline off the 1.3995 high). A break below 1.1050 would signal further downside towards greater targets near 1.0765, the September reactions lows and approximately 23% decline off the May 2014 highs,” Barclays projects.

For lots more FX trades from major banks, sign up to eFXplus

By signing up to eFXplus via the link above, you are directly supporting Forex Crunch.