The Canadian dollar flipped up and down on oil prices, still uncertain about the next steps of the Bank of Canada.

The team at Credit Agricole sees further depreciation of the C$ and sets a target:

Here is their view, courtesy of eFXnews:

The CAD has been in demand for most of the last few days, mainly on the back of better than expected housing and manufacturing sector-related data, as well as rebounding commodity prices.

However, we still expect the currency to remain subject to downside risk, in particular against the USD.

First of all, the most recent data does not indicate considerably improving growth prospects. On the contrary, still weak labour market conditions should keep inflation subject to downside risk unless commodity prices rebound more sustainably. However, in the absence of sustainably improving global business activity, commodity prices should remain at risk of weakening anew.

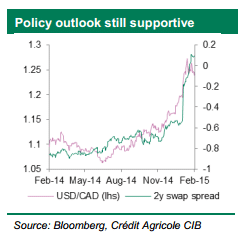

This in turn suggests that there is further room of diverging Fed-BoC monetary policy expectations to the benefit of USD/CAD. We remain long the pair from 1.2485 targeting 1.3050.

For lots more FX trades from major banks, sign up to eFXplus

By signing up to eFXplus via the link above, you are directly supporting Forex Crunch.