EUR/USD is suffering another downfall with the loss of 1.10. And this may only be the beginning.

The team at Barclays examines the situation and remains short:

Here is their view, courtesy of eFXnews:

In its weekly FX note to clients, Barclays Capital retains its structural USD bullish view projecting the greenback to keep its outperformance this year, and recommends using weakness to initiate long USD positions against the EUR where Barclays already maintains a position.

The following are some of the key points in Barclays’ note along with the details of its short EUR/USD position.

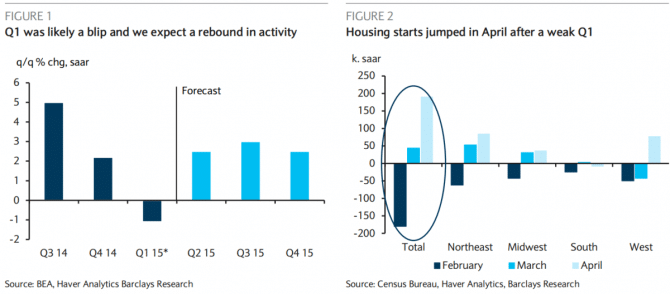

Disappointing US data and a more dovish Fed have tested our bullish USD view in recent months and that theme is unlikely to change this week as our forecasts for US data releases are mixed relative to consensus. However, foreign currencies are always a relative price and the US remains the economy most capable of generating inflation and the closest to rate hikes, in our view.

Durable goods and new home sales data on Tuesday may shed additional light on this dynamic further. We expect a below consensus print for durable goods ex-transportation (0.3% m/m vs. c.f. 0.4%) and an above consensus print for new home sales (510k vs. c.f. 481k). We also expect a positive surprise on pending home sales on Thursday with these growing 3% m/m (c.f. 0.9% m/m). Business and consumer sentiment indicators are expected to show improvement over the previous readings – Chicago PMI to rise to 53.0 from 52.3 (c.f. 53.0) and Michigan consumer sentiment at 90.0 from the 88.6 preliminary reading (c.f. 90.0). Finally, we will get the second estimate for Q1 GDP – we expect a downward revision to -1.1% q/q saar (c.f. -0.9%).

The Greek political saga will remain in the spotlight, likely holding implications for FX markets and the outlook for the EUR. Negotiations remain highly uncertain at a time when the liquidity situation has deteriorated further, ahead of important month-end pension and salary payments and circa €1.7bn IMF payments in June (5, 12, 16 and 19 June).

Despite incremental progress on the negotiation front, key differences between the Greek government and the institutions remain, testing the market’s recent complacency around the likelihood of a Greek default and exit.

Despite our view of a last-minute agreement, the dynamics of the necessary process remain highly uncertain. Even if a last-minute agreement was negotiated on a technical level, the implied U-turn on election promises would likely push the Greek government into some form of a political crisis, forcing a change in the current set up.

Staying short EUR/USD:

In line with this view, Barclays maintains a short EUR/USD position from 1.1240, with a stop at 1.1680, and a target at 1.0460.

For lots more FX trades from major banks, sign up to eFXplus

By signing up to eFXplus via the link above, you are directly supporting Forex Crunch.