Unfortunately, also seasoned traders fall into this trap of moving stop loss orders. And if it worked out for you once, it just worsens things for you. Are you doing that? Being aware of why you are doing it and the consequences can be a game changer.

Why do you move your stop loss?

So, you took a position in the wrong direction. This happens to everybody. You see the market approaching your stop loss, and you keep a safer distance from it, moving further away from the market and deeper into your pocket. And then you do it again and again. This usually results in a safe loss of money. More money than you planned to risk on the trade.

You may do it because you have new knowledge or a feeling that you now know where the right place to put your stop is. Confidence is great, but seriously, what new knowledge do you have since you placed the trade? Probably not too much. What makes you think that your new placement, while the trade is live, is better than your original plan, when you didn’t have a position, and were more calm?

The original plan was probably better, more balanced. Your hasty new plan isn’t likely to be better.

Another reason can be a fear to lose the trade. But let’s go back to the plan once again. You undertook a specific risk. Calculated risk is part of the game. Extending the stop loss is a bigger risk, that wasn’t calculated properly.

What happens next?

In the majority of cases, the market continues in the wrong direction for you. Why? Well, remember why you put the stop loss there? If the market will take the opposite direction, you just don’t want to be there, and cut your losses quickly. This logic was probably right, and you just lose more.

This means that you lost more than you intended to. This means that you’ll probably erase your account quickly and won’t have enough chances to improve, win trades and get your act together.

But what if the minority scenario works out? What happens if you move your stop losses, the market doesn’t reach them and then bounces in your favor. There’s a good chance you become over-confident. You believe that you can bend the rules.

So you’ll try to do it again, with a bigger-sized position. This may result in the regular scenario of losing more than you planned, and this time, the plans were more loose.

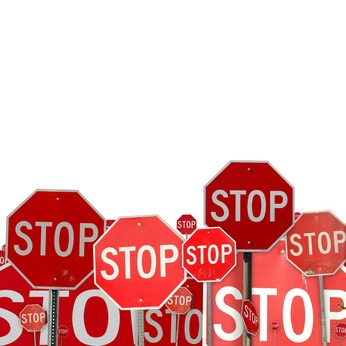

When you disregard a stop sign on the road, this may result in accident or a fine. The same goes for trading.

So please respect your own stop sign, otherwise you’ll get a big fine and your account will have an accident.

Further reading: How to chose a forex broker in 2011.