The US dollar is trading near a one-month low, while low yields in the world’s largest economies are propelling money back into the emerging markets, erasing all traces of the ‘taper tantrum’ that caused currencies to plunge last year.

Among the majors, the Australian, Kiwi and British units are all seeing nice support, while the euro remains pinned in place. With front month crude prices pushing through the $106 level, and likely to go higher as tensions grow in the Middle East, long positions on the major oil producers are building.

As flows into Canada’s Western provinces rise, consumption is growing rapidly – as exhibited in the strong retail sales and inflation numbers that were released this morning. Prices rose by 2.3% in May from a year earlier, blowing away expectations and positioning the currency for further upside as we go into “quadruple witching” day. Stock options, index options, index futures and single-stock futures all expire today, meaning that markets could be extremely volatile throughout the trading session.

With markets in such an ebullient mood, we would like to remind our readers that in the foreign exchange world, risk can take many forms – traumatic exchange rate realignments are just as likely when participants become extremely optimistic, as when they are terribly afraid.

With that in mind, we would suggest that the background threat level is rising. Monetary alchemists at the world’s central banks have successfully transmuted a relatively lacklustre recovery into a golden opportunity for speculators – asset prices are rising sharply, volatility expectations are near record lows, and interest rates are expected to stay low for the foreseeable future. Billions of dollars are flowing into markets previously considered risky, and the feedback loop between prices and fundamentals has become heavily distorted.

A “melt up”, in which markets suddenly surge to unsustainable levels is becoming increasingly possible – meaning that businesses should remain alert for signs that investors are becoming too greedy.

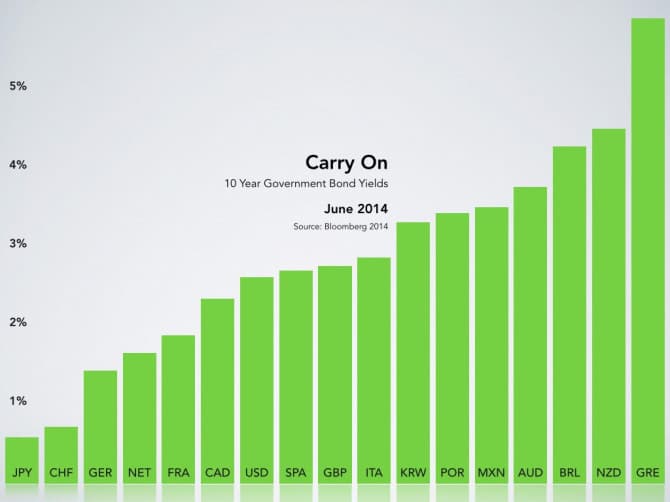

Carry On

To illustrate the wide divergences that we are seeing in global interest rates, the chart below shows 10 year government bond yields, effective yesterday. These differentials are key in understanding why the euro remains well supported – and why the carry trade is growing so rapidly.