On Thursday, at GMT 08:30 AM, the Swiss National Bank announced the interest rates. The outcome was in line with the expectations, as the Swiss National Bank reaffirmed minimum exchange rate of CHF 1.20 per Euro, and decided to keep the interest rates at 0 percent.

No policy change was introduced, as the central bank re-iterated the need of EURCHF cap. The central bank even said that “the SNB stands ready to enforce the minimum exchange rate, if necessary, by buying foreign currency in unlimited quantities, and to take further measures as required.”

CHF Strength

The recent strength in the CHF did not go down well with the central bank, as the Chairman of the Swiss National Bank Thomas Jordan mentioned that since the Swiss Franc is considered as a safe haven, it becomes very difficult in the times of crisis to maintain the policy as required. It is worth noting that the Swiss franc recently gained a lot of traction against most of the major currencies, as the tensions in the Ukraine escalated. This becomes more problematic for the central bank. However, the central bank doesn’t think that there will be any need of intervention in the short term.

Economic projections

The central bank lowered the inflation forecast. They now expect the inflation rate to be around 0 percent, compared to previous expectations of 0.2 percent for 2014. In 2015 and 2016 the inflation rate is expected to be around 0.4 percent and 1 percent respectively. In terms of growth, the central bank now expects economic activity to pick up from the first quarter of 2014, and anticipating GDP growth of around 2 percent for 2014 as a whole.

Technical Analysis

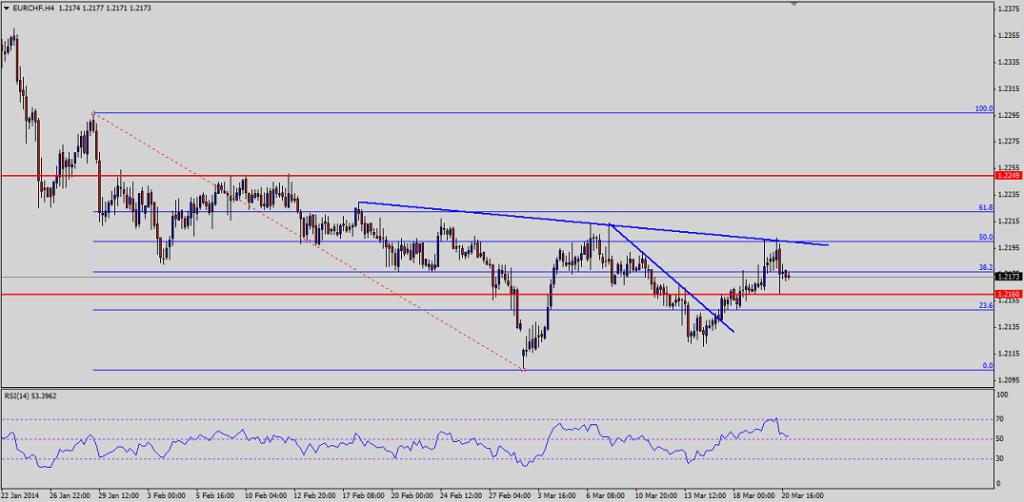

The EURCHF traded higher after the release, as the CHF currency lost luster across the board. The EURCHF climbed higher, and broke an important down-move trend line, as highlighted in the chart shown below. However, the bull-run stalled right around another down-move trend connecting all major swing highs. The buyers struggled to take the pair higher above this resistance zone at around the 1.22 figure, which also represents the 50.0% Fibonacci retracement level of the last down-move from the 1.2298 swing high. The pair fell back sharply towards the 1.2160 support level, where buyers appeared again. The RSI is coming closer to the 50 level, which could hold in the short-term and the pair might bounce from the 1.2160 support level.

KEY SUPPORT LEVELS: 1.2160 and 1.2140

MAJOR RESISTANCE LEVELS: 1.22 and 1.2240