59 Tomahawk missiles have been fired from US ships on targets in Syria. This is a response to the atrocious attack by the Assad’s regime on its own civilians, using chemical weapons. The move made by the Trump Administration had the intention of warning Assad to refrain from further attacks. It seems there was no urge for a wider involvement of US troops in Syria.

The strike has wider implications. Russia is involved in the civil war in Syria supporting the regime. Russia’s President Vladimir Putin condemned the strikes. Earlier, Russia deflected the blame that Assad was responsible for the use of chemical weapons.

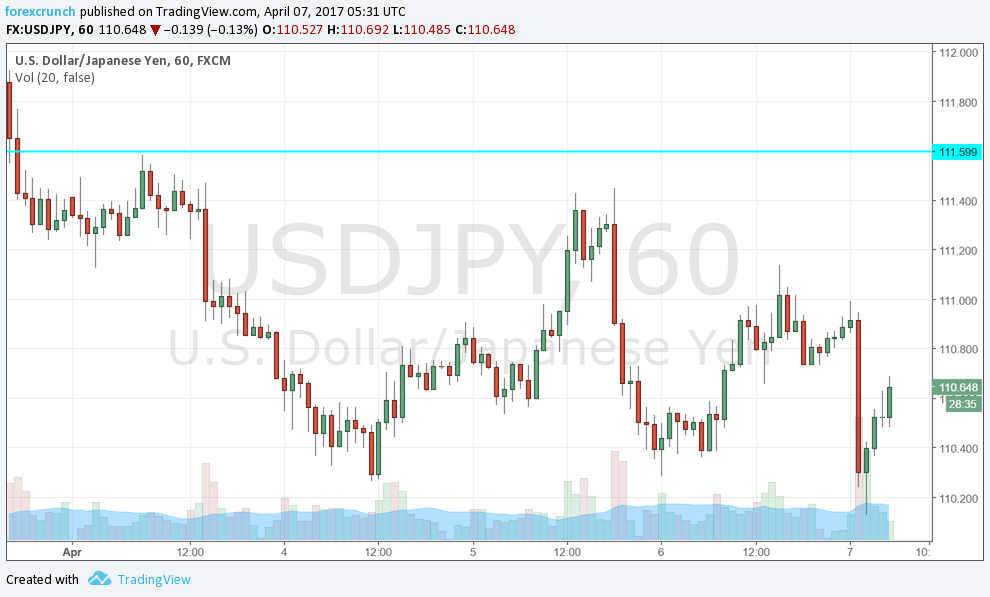

The move, a deterioration in international relations is a clear “risk-off” event. The currency that benefits most from safe-haven flows is the Japanese yen. The yen indeed strengthened. USD/JPY dropped to a new cycle low of 110, but failed to move under the stubborn line of support. 110.13 is the trough for now.

Other assets that are moving on the news from Syria are oil and gold. Both are on the up and up. Gold is seen as a safe haven asset while oil is rising on fears of a disruption of oil supplies from the Middle East.

Here is how USD/JPY looks. Close, but no cigar.