While the focus is on the pound, also the Australian dollar and the yen are on the move. Here are levels to watch:

Here is their view, courtesy of eFXnews:

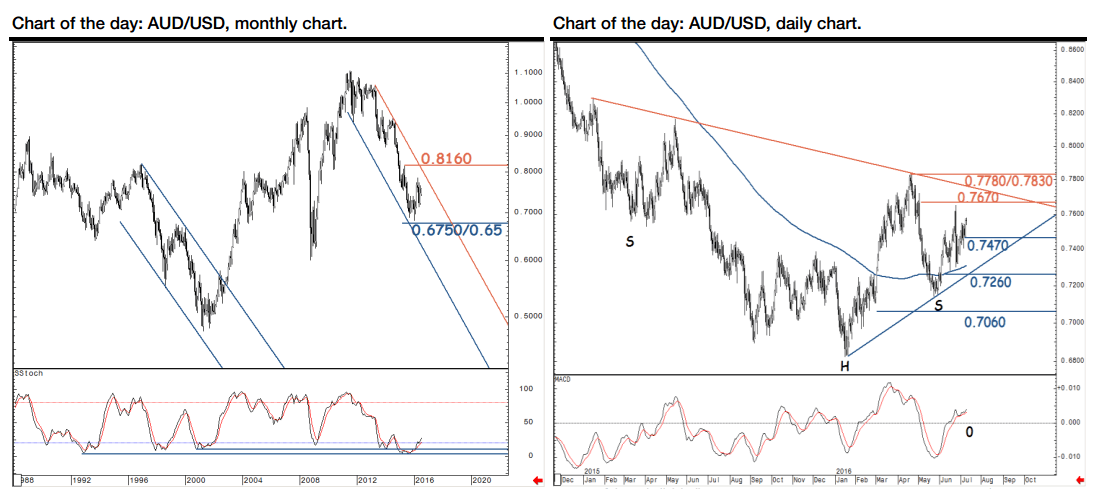

AUD/USD underwent an elongated downtrend until January this year. Of note is that the down move has been framed within a multiyear descending channel and appears similar to the one in 1990s. Monthly stochastic indicator has started inching higher after testing a floor which indicates early signs of stabilization. If we drop down to daily chart, AUD/USD recently probed the 200 day MA tentatively and approached towards support of 0.7060, the 76.4% retracement of first leg of recovery.

It appears to be evolving within a probable inverted H&S which points towards possibility of upside. With daily MACD in positive territory,a move towards 0.7670 and even towards the neckline at 0.7780/0.7830 looks likely.

USD/JPY is showing a recovery after sustaining above our earlier highlighted support level of 100, the 50% retracement of whole uptrend since 2011. With daily RSI near a multi month trend, a rebound looks plausible towards highs formed earlier this month at 103.60/103.80.

For lots more FX trades from major banks, sign up to eFXplus

By signing up to eFXplus via the link above, you are directly supporting Forex Crunch.