The dollar has taken a turn down after strong weeks of rises. What’s next for the greenback?

Emanuella Enenajor of Bank of America Merrill Lynch analyzes the fundamentals:

Here is their view, courtesy of eFXnews:

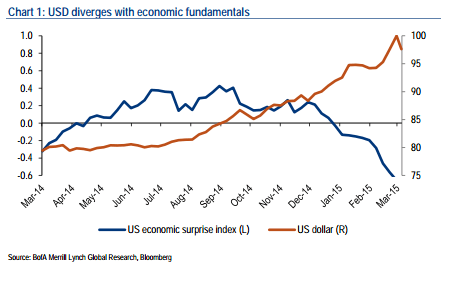

“In mid-2014, upside surprises in US economic data triggered the start of a persistent appreciation in the dollar. We have argued that the currency’s appreciation was an endogenous response to underlying economic fundamentals, suggesting little reason to fret.

But recently, there has been a string of disappointments in the economic data. In spite of the weak economic news, the currency has continued to rally. A more cautious tone from the Fed recently has taken some shine off of the greenback, but the trend is still up.

Indeed, our FX Strategy team sees further upside in the USD. In our view, there are two key factors driving these trends. The first factor is central bank easing abroad. The second factor has been investors’ extrapolative expectations of a continued rally on Fed hawkishness. Neither of these two factors are a reflection of strengthening US growth.

1. Global central bank easing: Disinflationary risks combined with downside risks to growth have triggered central bank easing in key trading partners such as Canada and the Eurozone. The associated declines in their currencies have, by default, boosted the value of the trade-weighted US dollar.

2. One-track-minded markets: Although the Fed has emphasized data dependency, they have been largely dismissive towards the dollar’s ascent. As a result, the dollar has been on a tear. Markets may be putting too much emphasis on the solid jobs data, ignoring weakness elsewhere.

While the Fed may have happily looked past the USD rally last year as it was an endogenous response to stronger growth, the more recent domestic data have been notably weak. Also, as we have argued in our latest Ethanomics “The war against deflation”, the US faces similar disinflationary risks that global central banks are now battling, and markets aren’t putting enough emphasis on the possibility of delay in the Fed exit to September or beyond. If the dollar continues to rally as our FX team predicts, the risks are growing that the Fed will start to view the USD rally as an exogenous headwind, rather than an endogenous signal of stronger growth.”

Emanuella Enenajor – BofA Merrill Lynch

For lots more FX trades from major banks, sign up to eFXplus

By signing up to eFXplus via the link above, you are directly supporting Forex Crunch.