In the wake of the ECB meeting last week, I detailed why I thought Trichet would go down in flames for signalling a July interest rate increase at a time when there were so many risks to the eurozone outlook, not least the fragility of the banking sector given the risk surrounding Greece. These risks are now playing out, offering even more evidence that a tightening of monetary policy next month would be a disastrous move.

Guest post by FXPro.

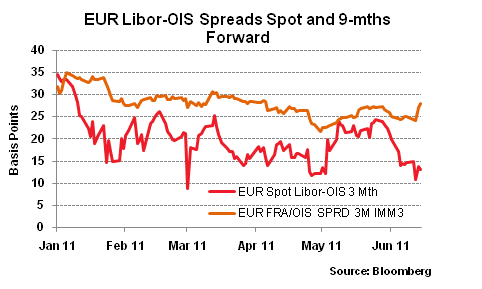

This is most evident in the inter-bank lending markets, where the difference between these rates and equivalent swap rates has widened out dramatically this week. The wholesale lending market, whereby banks lend to each other on an unsecured basis, was where the initial impact of the credit crisis was felt back in July 2007. Banks, worried about the creditworthiness of others, basically cut credit lines to others. The market had mostly normalised by the early part of this year in terms of spreads, but remains pretty illiquid beyond 1-mth maturities, with such lending not sitting comfortably with tightened risk-management parameters. Back in 2007, banks were concerned about where the sub-prime time-bombs were sitting. This time they are concerned with where the Greek bonds are parked. At least there is greater clarity than was the case back in 2007, with BIS data and stress tests last year giving us a clearer picture of where the risks lie (principally in French and German banks).

But knowing where the risks lie does not necessarily make the consequences any easier to bear. Not only would these be felt in the German and French banking sectors, but the implosion of Greek banks would also have fairly notable consequences for the CEE area, with Bulgaria and Romania suffering from their exposure to the Greek banking sector.

Right now, the ECB is taking a fairly hard line in terms of resisting anything but a fully voluntary private sector debt-restructuring, despite the fact that they are chasing an impossible dream. But on monetary policy, they need to show more flexibility and there is still the scope to do so. The anticipated tightening of policy has not yet officially arrived. But the move higher in Libor-OIS spreads and consequent tightening of monetary conditions will likely deliver a tightening anyway, especially for those with Libor-linked mortgage commitments (e.g. Spain). For the ECB to add to this in July would be a grave error.

Simon Smith, Chief Economist

Disclaimer: This material is considered as a marketing communication and does not contain and should not be construed as containing investment advice or an investment recommendation, or, an offer of or solicitation for any transactions in financial instruments. Past performance does not guarantee or predict future performance. FxPro does not take into account your personal investment objectives or financial situation and makes no representation, and assumes no liability to the accuracy or completeness of the information provided, nor for any loss arising from any investment based on a recommendation, forecast or other information supplied from any employee of FxPro, third party, or otherwise. This material has not been prepared in accordance with legal requirements promoting the independence of investment research, and it is not subject to any prohibition on dealing ahead of the dissemination of investment research. All expressions of opinion are subject to change without notice. Any opinions made may be personal to the author and may not reflect the opinions of FxPro. This communication must not be reproduced or further distributed without prior permission of FxPro.