The market takes its time when it comes to digesting FOMC Statements. The initial dollar strength was small, and now it gains traction.

Updates on the reactions, which are different than behavior seen so far.

Not only did Bernanke and Co. refrain from any mention of QE3, they also slightly modified the language and mentioned improving employment and rising inflation.

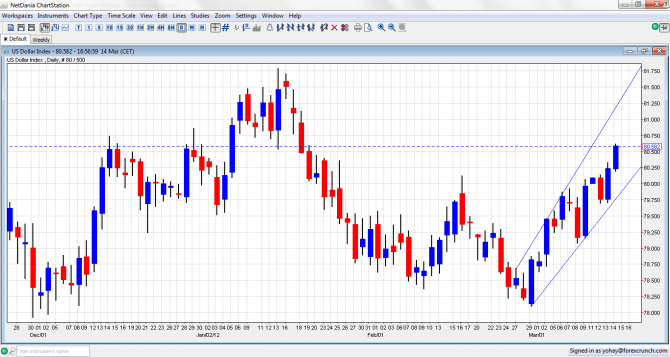

The US Dollar Index is around 80.58, rising strongly in the past few days, and continuing the move in the uptrend channel:

The Aussie and the kiwi are the biggest victims. AUD/USD is around 1.0440 and NZD/USD is at 0.8080. Both currencies have high interest rates and are clear “risk currencies”. They tend to rise with stocks and fall with them. This correlation has been broken.

The former “safe haven” currencies continue suffering. USD/JPY is already at 83.78, continuing the non-stop rise. Higher US yields certainly push the pair higher. The yen used to strengthen when the dollar strengthened against risk currencies. It’s not special anymore.

The Swiss franc isn’t a safe haven since the big SNB intervention. It finds itself weakening more than the euro and the pound. USD/CHF is above 0.93.

The changes in correlations are significant. See more about the change in forex correlations in this video.

EUR/USD, the world’s most popular pair, is chopping down slowly. Despite getting the final approval for the second Greek bailout, the pair is too close to the 1.30 line. It isn’t a strong line, and could be broken soon. 1.2945 is more important.

GBP/USD is a bit stronger than EUR/USD, but it is also sliding under 1.57. Mediocre employment figures didn’t help.

The Canadian dollar continues differentiating itself from the other commodity currencies. US strength means Canadian strength. USD/CAD is rising a bit, but the pair remains under paritiy, in the 0.99 to 1.00 range.

It’s also important to note that silver, oil and gold are on the fall. Silver leads the pack down, but also gold is melting down. This usually happened when stocks were falling. This is another big change. For more on commodities, see Trading NRG.

All in all. Times are a-changin’.