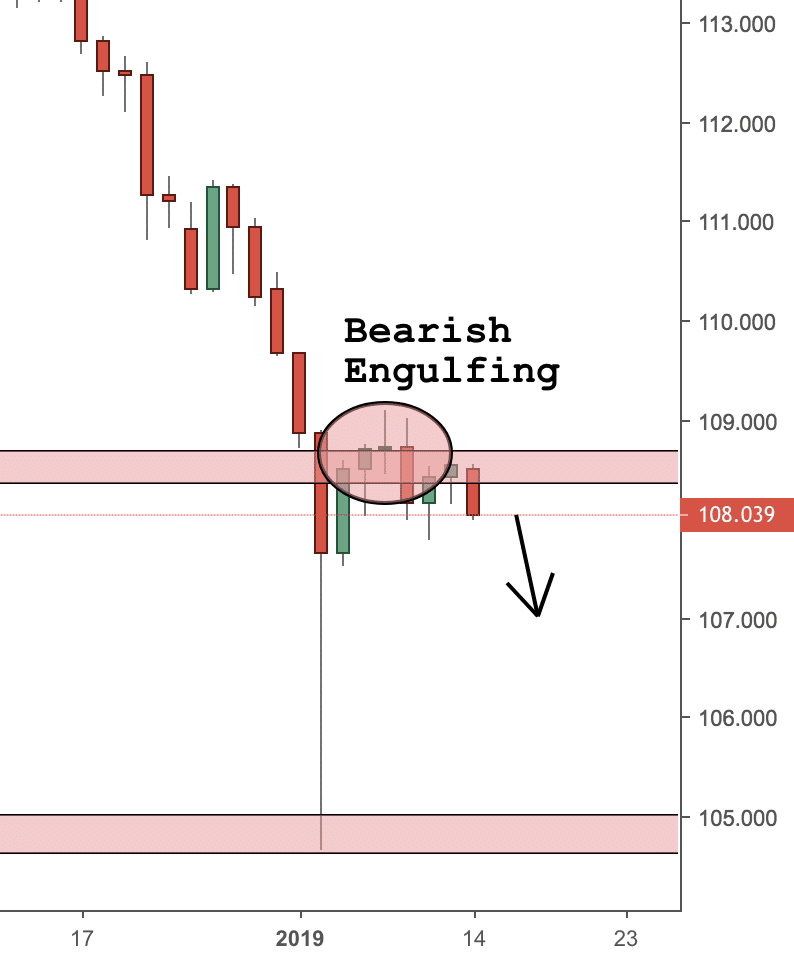

I am looking at the USDJPY pair. It looks like the bears are in control of price action again.

After the flash crash from last week, there is some new selling enthusiasm that is developing. There are a few technical indications that tell me a continuation of the downtrend is imminent.

- There was a bearish engulfing candle on the daily chart from 9th of January

- There is a potential second bearish engulfing pattern on today’s daily close (still needs to be confirmed)

- There is a strong resistance level at 108.50, which has not been broken yet

I will be looking for a clear break below 108.00 before a new bearish continuation forms. Alternatively, I will be watching to see if price bounces back from 108.00 and then forms another rejection candle at 109.00, where is the current resistance level.

I will be also following the 4H chart and if there is a price action candlestick that confirms my bearish outlook, I might consider taking it.

Happy Trading,

Guest post by Colibri Trader