- The USD/CAD dropped to the lower ground, pushed by US Dollar weakness rather than C$ strength.

- The double-feature Friday with Canadian inflation and retail sales stands out.

- The technical picture is evenly balanced, and the pair is looking for new clues for its next move.

A US-Canadian ugly contest, Iranian oil and still no NAFTA

The US Dollar continued enjoying upside momentum early in the week, using Powell’s no-news speech to extend its gains. Then came Trump’s Iran decision. The US President decided to ditch the JCPOA, more commonly known as the Iran deal.

The abandoning and the accompanying sanctions helped oil prices extend their gains. At first, the news also triggered a risk-off sentiment that weighed on the loonie but the mood improved quickly, and the Canadian Dollar enjoyed rising oil prices. The USD/CAD moved away from 1.3000.

The pair got another kick down as US inflation missed expectationswith 2.1% on the core figure against 2.2% expected. The US Dollar rally ran into considerable trouble as this disappointment joined the unimpressive jobs report in the previous week.

The Dollar rally may have reached an end.

But just as everything was going against the USD/CAD, also Canada had its share of weak data. The nation lost 1,100 jobs in April, worse than an increase of 17,400 that was on the cards. There were some silver linings: full-time employment was up and wages advanced by 3.3% YoY. Nevertheless, the USD/CAD made a last-minute recovery.

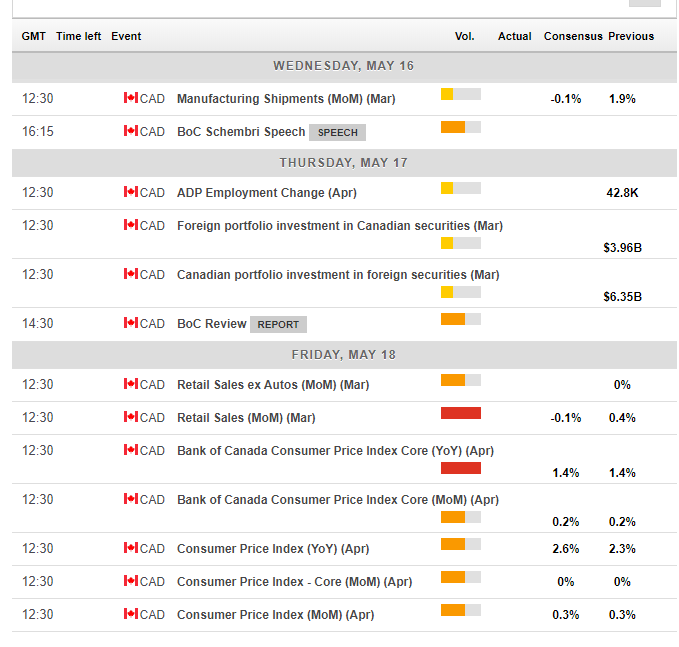

Canadian events: Inflation and Retail Sales

The first noteworthy Canadian indicator is due on Wednesday. Manufacturing shipments jumped back in February and may slide now. Lawrence Schembri, the Deputy Governor of the Bank of Canada, will give a speech on that day as well.

Thursday sees the ADP Employment Change report. Back in March, the firm showed an upbeat gain of 42,800 positions. Will it show better numbers than the official release also now? The BOC Review will shed some more light on the economy, yet it carries weight than the Bank’s Business Survey.

Canadian events culminate on Friday with the double-feature Inflation and Retail Sales reports. Headline Retail Sales rose by 0.4% in February and may drop now. Core sales may steal the show if the headline comes out as expected.

Inflation missed expectations in the report for March with a rise of only 1.4% YoY in Core CPI. A similar number is on the cards now. Headline CPI rose by 2.3% and could extend its increases, especially as oil prices have risen. In case both the Core and the headline meet expectations, perhaps the other core measures published by the Bank of Canada will have a greater effect. The Trimmed, Median and Common CPI measures are announced, and markets could take a look if the more critical data does not stand out.

NAFTA talks continue, but an immediate agreement is not imminent. Mexicans go to the polls on July 1st to elect a new President. Campaigning is in full swing, but all sides have vowed to make their best efforts to strike an accord. So far, things are moving quite slowly. An announcement about a deal would lift the loonie.

Here are the upcoming events that will drive the Canadian dollar as they appear on the forex calendar:

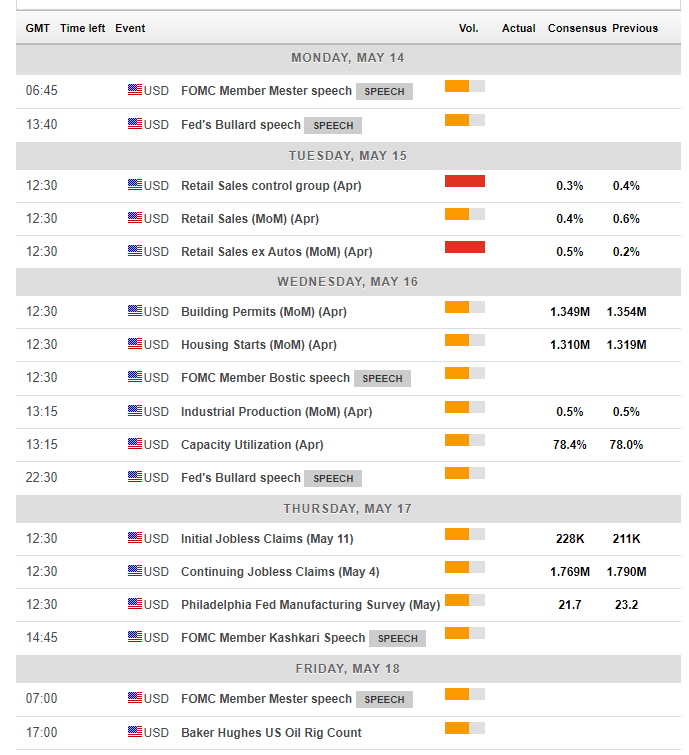

US events: Focus shifts to the consumer

US retail sales stand out in the American calendar. The US consumer has been somewhat hesitant in the first quarter of 2018 and markets will want to know if there is a pickup in the Spring. Apart from the headline, the Control Group is of interest in Tuesday’s release.

Housing and Industrial Production figures on Wednesday will have an impact if they go in the same direction. Building Permits and Housing Starts sometimes offset each other. Jobless Claims and the Philly Fed Manufacturing Index stand out on Thursday.

Various Fed officials will speak out during the week, with more doves such as Kashkari, Bullard, and Bostic outnumbering one hawk: Mester.

Political events around the fallout from Trump’s move on the Iran deal may also affect the US Dollar, especially if the situation in the Middle East deteriorates. At the moment, the deal is set to continue without the US, and the skirmishes between Iran and Israel have not escalated.

Here are the critical American events from the economic calendar

USD/CAD Technical Analysis – Looking for a new direction

The USD/CAD does not enjoy bullish momentum anymore. The RSI is near balanced around 50, and the pair lost the 50-day Simple Moving Average. It remains above the 200-day SMA.

All in all, it is looking for a new direction.

Resistance awaits at 1.2805 which worked as support for the pair in late April and early May. The attempt to recapture the line on May 11th did not succeed. The level is a proper separator of ranges.

Further above, 1.2860 capped the pair in late April, a temporary stepping stone on its way up. 1.2915 was the top of the range around the same time, and until the pair made a move higher in early May. The round number of 1.3000 remains potent.

On the downside, the May 11th low of 1.2730 is an immediate line of support. It is followed by 1.2680 which a swing high in early February. Further below, 1.2630 capped the pair in March.

Where next for USD/CAD?

The jobs report took the momentum out of the recovery of the Canadian Dollar. We could see some consolidation and even a resumption of the upside. The pair is data and NAFTA dependent.

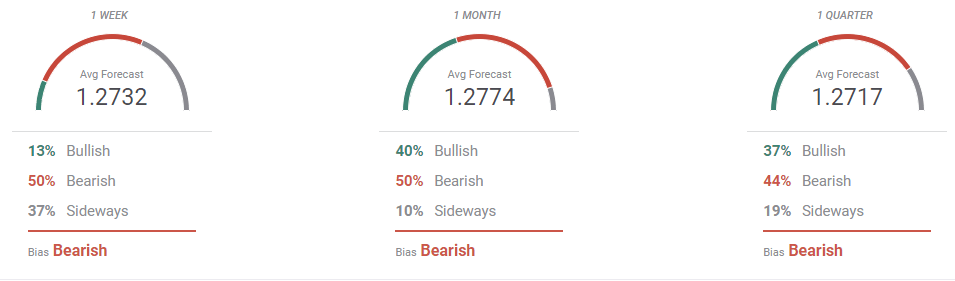

The FXStreet Forecast Poll shows a bearish sentiment on the pair, differing from the opinions expressed here.

-636616494451344734.png)