- The Fed leaves rates unchanged as expected.

- The median dot plot suggest none of the Fed members sees any changes through to the end of 2022.

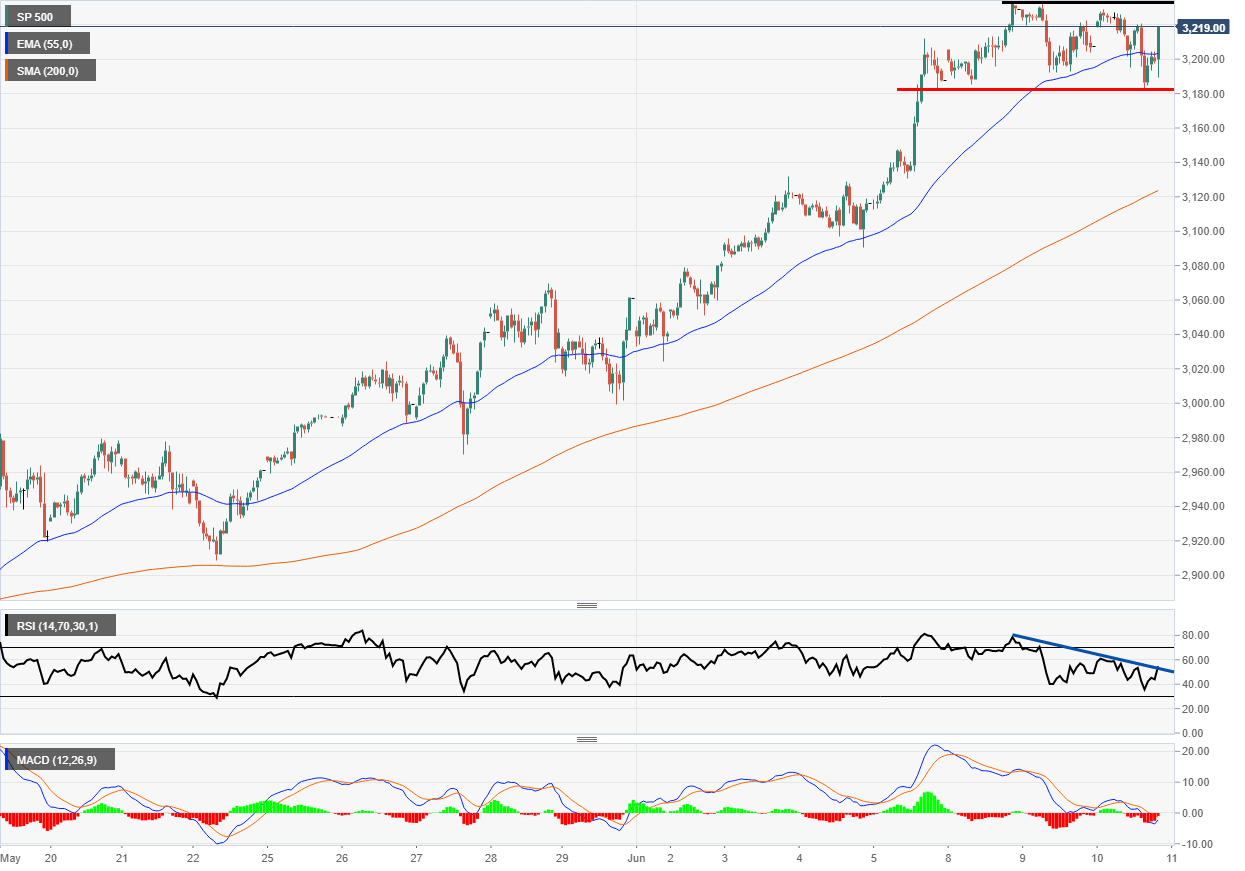

S&P500 1-hour chart

The 1-hour chart shows that the price has pushed through the 55 period Exponential Moving Average to the upside after the FOMC members suggested they will not move on rates through to the end of 2022. There had been some outside calls that towards the end of 2022 some of the Fed officials might predict enough of a recovery to make a small move higher in rates.

The key level to watch now is the high of 3,233.25 as if it breaks it will indicate a trend continuation and some more potential that the S&P 500 could hit the pre coronavirus highs like the Nasdaq index.

Additional levels