- The VIX shoots higher as stocks take a dive on Wednesday.

- The index reached a high of 37.12 after some technical support.

Fundamental backdrop

There has been a series of negative coronavirus related headlines on Wednesday as US states continue to struggle with the pandemic. In a string of bearish news headlines, the rise in cases is a massive problem. California is said to have seen an 18% increase in COVID ICU cases in just 2 weeks. Florida’s COVID-19 cases rose 5.3% Vs. previous 7-day avg. 3.7%. Just to name a few.

Equities then moved to the downside with the S&P 500 is currently 2.71% in the red. The worst performing companies coming from the travel sector once again. All five firms at the bottom of the S&P 500 performance list coming from that sector as New York impose a 14-day quarantine for anyone entering the state.

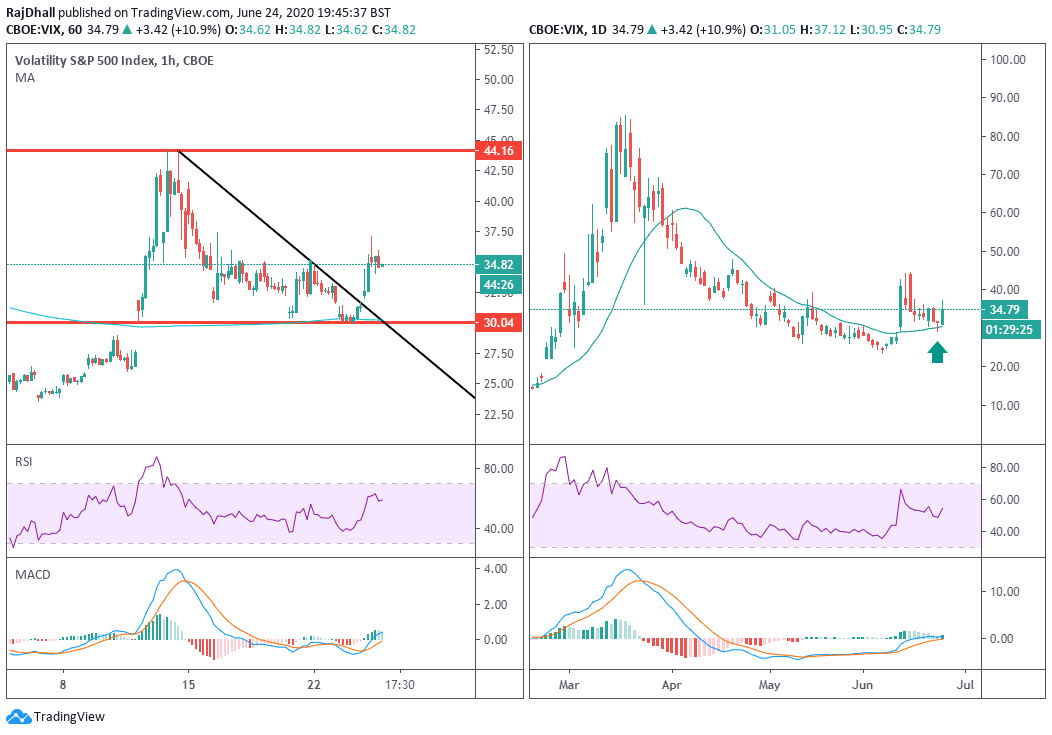

VIX 1-hour (left) and daily chart (right)

Looking at the daily chart on the right, it is clear to see the market used the 200 Simple Moving Average (SMA) as a support zone. Even on the hourly chart, the 200 SMA was used, highlighting its importance. Then the black hourly downward sloping trendline was broken to the upside and the wave high of 41.53 could be the target from the daily chart.

Both charts have a positive MACD as the histogram is green on both timeframes. The signal lines also look like they are about to cross on the daily with the hourly mid-line already breached. Lastly, if the bearishness continues over the week the red resistance line on the hourly chart is the one to watch and break there could indicate further trouble in the equities markets.