- The VIX is trading at 29 on Wednesday as the global risk sentiment is finely balanced.

- The price is still holding above the 200 period Simple Moving Average.

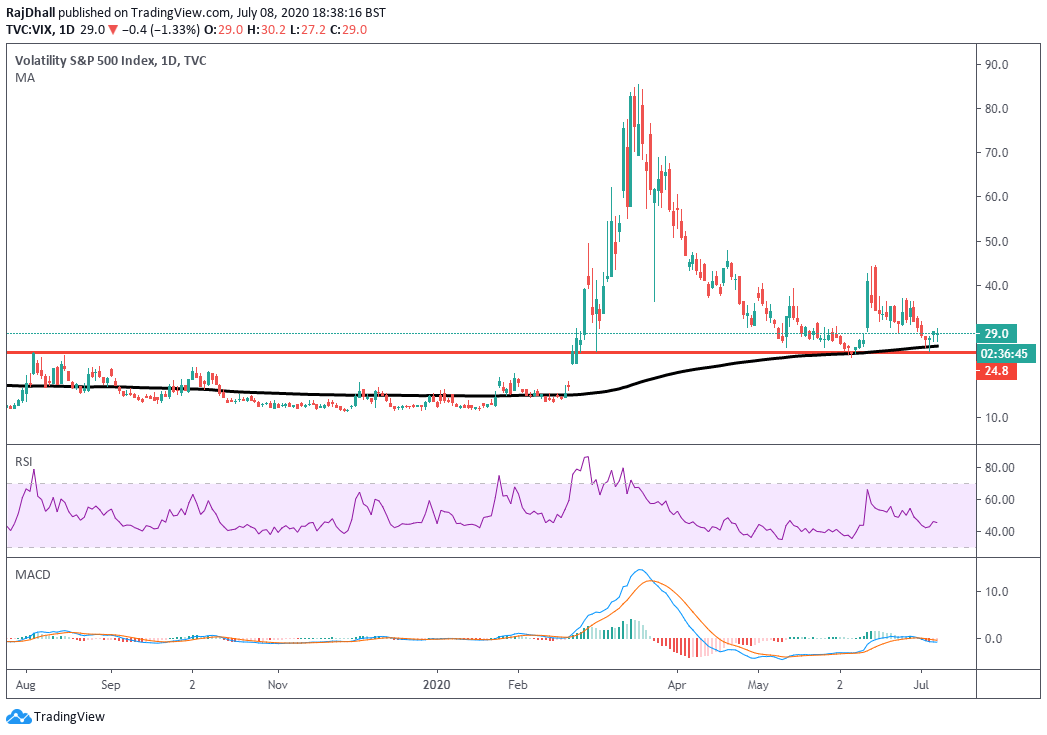

VIX daily chart

The VIX is moving in the right direction for the equities bulls but only just. At the open, the mark gapped slightly lower but then the market got very choppy and the VIX started to rise again. Since then, the price has dipped again after meeting resistance at 30.00 and has settled at 29.18.

At one stage the volatility index was as low as 28.20 but there has been some selling in the equities markets and the price has moved higher. For the rest of the session, all eyes will be on the 30.00 level to see if it can be broken once again.

One of the main features on the chart below is the 200 Simple Moving Average. If the bulls manage to grab hold of equities then this could break to the downside but the 24.8 support lies in wait. A break of the aforementioned support would take the VIX back to the more traditional “normal” levels seen in the pre-COVID bull market.

Ironically, CBOE Global is one of the worst performers as it was a couple of sessions ago. This time out falling over 10% but there has been an acquisition recently but some short sellers have cited lower trading volumes. On the topside, Twitter (8.24%) is performing well as it was announced the company might be working on a new subscription-based platform. There are not too many details about the platform but just that it would be linked to a payment gateway.