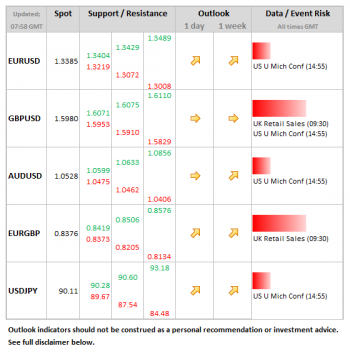

- USD: Just University of Michigan consumer confidence data announced, which has historically not been a big release for dollar impact, with less than 0.1% moves on the dollar index the maximum seen in recent releases.

- GBP: The retail sales data for December always a key one, but always handle with care as these are difficult for analysts to accurately predict, but could mean some near-term volatility today. Update: UK Retail Sales Drop – GBP/USD Extends Drops. Note that the prime minister’s key speech on Europe has been delayed from today.

Idea of the Day

The price action on the yen this week has mirrored that of last week, with two days of a stronger yen proving a sufficient breather for the bears. This means that the uptrend on both USDJPY and many of the yen crosses (EURJPY in particular) remains intact, with the key 90 and 120 levels breached in overnight trade. The level of expectation that has built up ahead of next week’s meeting of the Bank of Japan is pretty firm, with more speculation overnight of possible measures that may be introduced. At a minimum, a move higher and a strengthening of the BoJ’s inflation goal is expected (from 1.0% to 2.0%) and anything less than this will meet with disappointment. Overall, the bigger trend remains for a weaker yen, but barring any major surprises next week, it’s likely to be a more choppy ride within the USDJPY uptrend.

Latest FX News

- EUR: Against the dollar, threatening to test the highs of the year (currently at 1.3404), with EURJPY moving above the 1.20 level late yesterday.

- JPY: The final Nov industrial production numbers revised a little higher which gave a marginal boost to sentiment ahead of the BoJ meeting next week. USDJPY has touched the 90 level in overnight trade. Resistance is at 90.28. Talk of more changes (to interest on reserves) at next week’s BoJ meeting. More talk from officials also pushing the currency lower.

- GBP: The Prime Minister has cancelled a much awaited speech on Europe that was due today owing to the hostage crisis in Algeria.

- CNY: The Q4 GDP numbers were a touch better than expected at 7.9%, up from 7.4% and a touch stronger than expected. The impact has more been felt in Asian stocks, the Nikkei up nearly 3%.

Further reading: Euro to face headwinds from deepening recession, debt crisis