- The USD/JPY inched higher amid a stronger USD, a dovish BOJ, and trade talk.

- A calmer week sees US inflation and also Japanese GDP.

- The pair holds onto uptrend support, a positive technical sign.

This was the week: BOJ, Fed, yields, and trade

The turn of the month was packed with events. The Bank of Japan made some tweaks to its policy, such as enlarging the band permitted for the 10-year yield. However, they remain far from the 2% core inflation goal, and their policy remains very loose, weighing on the yen.

On the other side of the Pacific, the Federal Reserve left its policy unchanged and made marginal changes to its wording. They now see the economy is strong and in general, remain on track to raise rates in September.

US 10-year bond yields flirted with the 3% level amid growing borrowing needs by the government. The tax cuts and increased spending increase the deficit.

On the trade front, the sense of truce is gone. While NAFTA negotiations are progressing smoothly, US-Sino relations have deteriorated again. The two economic giants were reportedly seeking to restart negotiations, but a lack of progress resulted in the US threatening to raise the tariff from 10% to 25% on $200 billion of Chinese goods. China devalues the yuan in what seems like a retaliation. The imposition of these duties is due at the end of the month.

The USD/JPY fell alongside stock markets, indicating the return of the Yen to its safe-haven role.

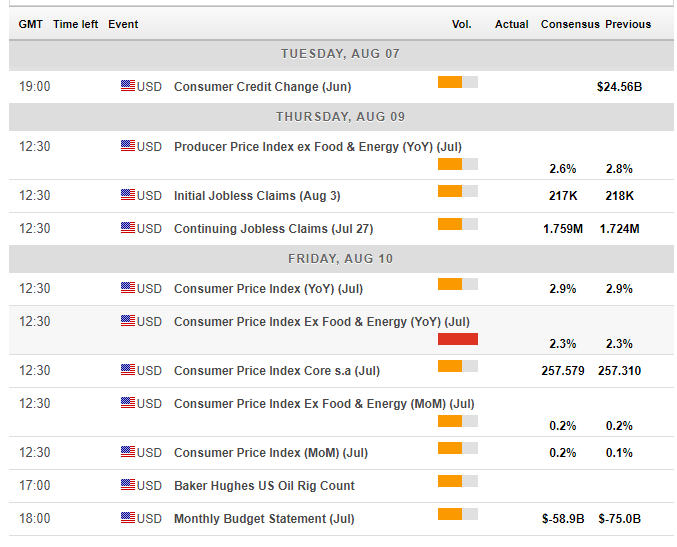

US events: Culminating in inflation Friday

After a strong start to the new month, the first full week of August is calmer. It begins with Consumer Credit on Tuesday and becomes more interesting with the Producer Price Index on Thursday. Core PPI is rising at a faster pace than consumer inflation, reaching 2.8% in June. The figure for July is expected to be more moderate.

The primary event of the week is the Consumer Price Index (CPI) for July, published on Friday. The Federal Reserve cares primarily about core prices, and these have accelerated to 2.3% YoY in June. A repeat of the same level is on the cards now. It is important to note that despite an increase in the Core CPI, the Core PCE dropped to 1.9%. The central bank explicitly targets core prices.

Apart from economic indicators, bond yields are gaining traction once again as movers of the US Dollar. Higher 10-year yields are positive while a flattering of the yields curve, a rise in the two-year vs. the 10-year, is US Dollar negative.

Here are the top US events as they appear on the forex calendar:

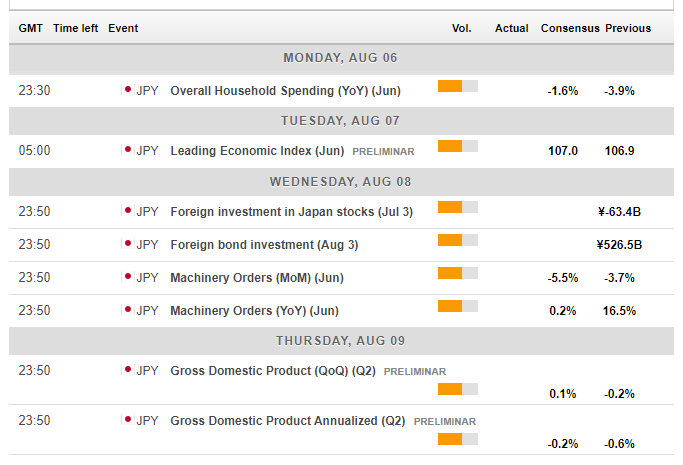

Japan: GDP and the safe-haven role

The Japanese economic calendar features events every day. While the yen moves more on the BOJ, stock markets, and geopolitics, there are a few notable figures. Overall Household Spending on Monday is set to fall once again while the Leading Economic Index on Tuesday carries expectations for a rise.

Foreign investment in Japanese stocks was negative while bond investment was positive. It will be interesting to see the fresh data.

The preliminary GDP figures for Q2 will be of more interest. Economic growth was likely meager last quarter, only 0.1% QoQ. Year over Year, markets expect 0.5%.

The yen’s behavior is tentatively changing back to its traditional role: a safe haven currency. Another fallout between the US and China will thus boost the yen while negotiations could send it lower. It was somewhat hard to note this reversion in a week that featured so many other events. A calmer week may test this old/new reaction function.

Here are the events lined up in Japan:

USD/JPY Technical Analysis

The USD/JPY continues trading above uptrend support, and this serves as a bullish sign. Other indicators are also upbeat: the pair is above the 50 and 200-day Simple Moving Averages, the Momentum is positive, and only the Relative Strength Index (RSI) is listless.

All in all, the bias is somewhat bullish.

The early-August high of 112.15 coincides with the support that the pair enjoyed while trading on higher ground in July. Further above, 113.20 was the peak in July. Looking to higher ground, we are back to levels last seen in January, 113.45.

111.40 capped the pair in mid-May and continues playing a role. Further down, 110.50 held the USD/JPY from falling in late July. 110.25 was a low point in early July and defends the round 110.00 level.

USD/JPY Sentiment

The Fed is hawkish and the BOJ is dovish, but that does not imply gains. A lot depends on trade relations between China and the US and the reactions in stock markets. The ongoing tensions are likely to balance any upside movements.

The FXStreet forex poll of experts provides additional insights.

-636688831389350686.png)