- The Bank of Canada is set to leave rates unchanged but acknowledge robust growth prospects.

- Rising oil prices are also supportive of the economy and the currency.

- It is hard for the BOC to fight higher yields while the Fed always US ones to rise.

The Europeans and the Japanese dislike higher yields – and Australia is fighting against them – but will the Bank of Canada be able to do the same and push the loonie lower? Probably not.

While the BOC would like long-term borrowing costs to remain low – thus supporting the government’s fiscal stimulus and investment – it may be unable to do so. Here are three reasons for a potential failure.

1) Growth is strong

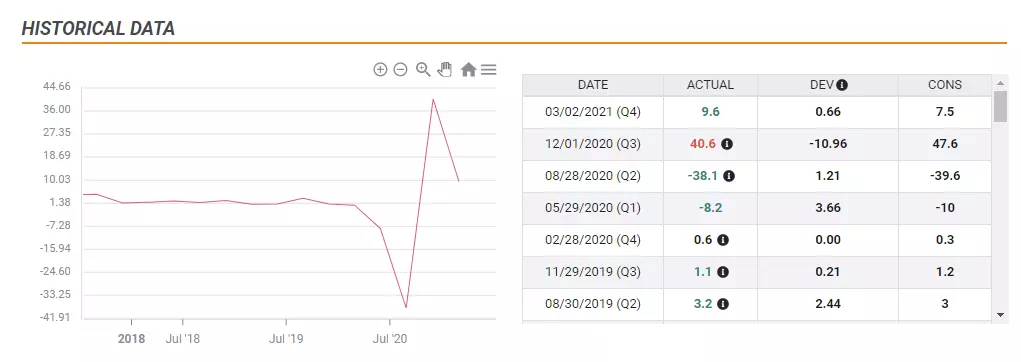

The Ottawa-based institution is set to release updated growth and inflation forecasts in its upcoming March 10 meeting, and these will likely be upgraded. The Canadian economy grew by 9.6% in the fourth quarter, far better than expected and laying the basis for a promising 2021. That expansion came before vaccine deployment.

It will be hard to justify any effort to lower returns on debts when prospects are elevated. BOC Governor Tiff Macklem, who holds a press conference after this publication, will find it hard to answer questions about desired low yields just after presenting a rosy picture.

Source: FXStreet

2) Oil is on the rise

While the environmentally-minded Canadian government is trying to pivot away from dependence tar sands oil, the province of Alberta is still reliant on exports and the BOC acknowledges oil’s importance to the economy. The recent OPEC+ decision to extend production cuts has pushed petrol prices higher – making relatively costly Canadian oil more attractive to extract.

Exports of the black gold have been material to the C$, and only by recognizing the impact of elevated output, the BOC would give a green light for additional gains.

3) The BOC and the Fed

Roughly three-quarters of Canadian exports go to the US, and monetary has often followed that of the Federal Reserve. That makes the BOC’s monetary policy more tied to comments by Fed Chair Jerome Powell than any other central banker – including in fellow commodity-exporting Australia.

If the Fed allows for Treasury yields to rise – seeing it as a sign of a rosier growth and inflation outlook – the BOC may find it hard to intervene and push long-term borrowing costs lower.

Conclusion

While no change is expected from Ottawa at this juncture, the mere reluctance to act forcefully against a steepening Canadian yield curve, may unleash fresh loonie strength.

It is essential to note that the BOC announces its decision just around a critical ten-year bond-auction in the US, so the full impact may not be immediately seen in USD/CAD. Nevertheless, the C$ has room to rise across the board.

USD/CAD Price Forecast 2021: The complications of COVID-19 on the loonie and the hope for a recovery

-637508874702908586.png)