Cannabis consumption will be fully legal in Canada on October 17th. Companies providing the weed are going high, at least in terms of prices and in searches according to Google Trends.

Tilray stands out but also Canapy Growth, Aurora, and Cronos are gaining traction in stock markets. Trading in Tilray was halted several times, reflecting the extreme volatility and volume in the stock price.

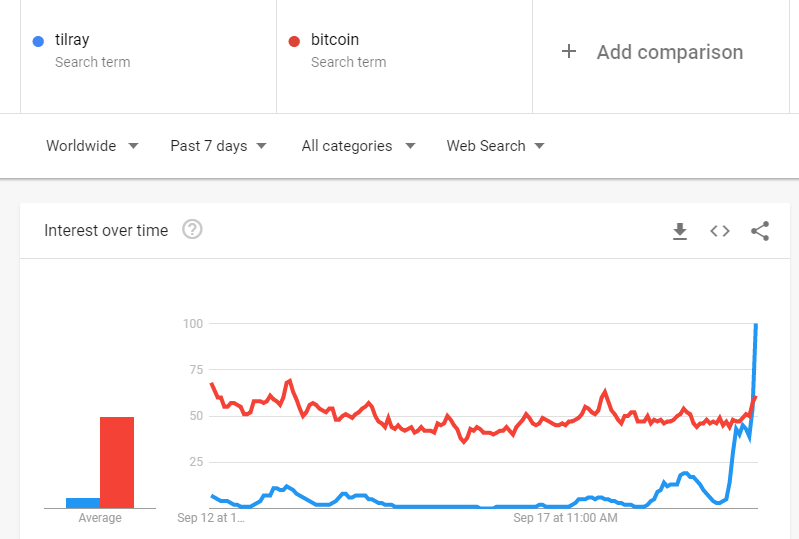

The interest in such investments may come from the same sources as those interested in cryptocurrencies: speculators interested in quick gains as a new market opens up. The effect may be detrimental to Bitcoin, Ethereum and other cryptocurrencies. Why? The same money may move away from digital coins and into stocks of providers of marijuana and other cannabis-related products.

Most of the funds that go into cryptos find interest in cryptos and the same goes for money that goes into stocks related to recreational drugs. Nevertheless, the speculative excitement may move from blockchain technologies to high-flying stocks such as this one.

The hype around Bitcoin caused some unrelated companies to change their names to include terms such as crypto, the blockchain, digital coins, etc. The mere change of the company name or its mission drew interest and surges in the stock prices. The same level of craze may be currently seen around cannabis stocks. The trend still needs to be confirmed as

Here is how interest in Tilray surged and surpassed Bitcoin at the time of writing, according to data from Google Trends.