Risky assets are higher today, because of cut in China’s reserve-ratio requirement over the weekend by 50BPS to 20.5%, effective from February 24th.

That means that banks are now allowed to lend more money, which of course is good for economy. That’s why we saw a gap higher on commodities, stocks and lower on USD dollar; against the majors, as usually in Risk-on situation.

Finance ministers from the Eurozone are expected to approve a rescue package for Greece today, which is also supportive for the risk trade.

In this week we still favor more strength on FX-majors against the USD since market reversed last Thursday; Euro from 1.2970, Cable from 1.5640, Swiss franc from 0.9300,…

We will keep an eye on some pairs for new trading opportunity with members in this week.

Guest post by Gregor Horvat

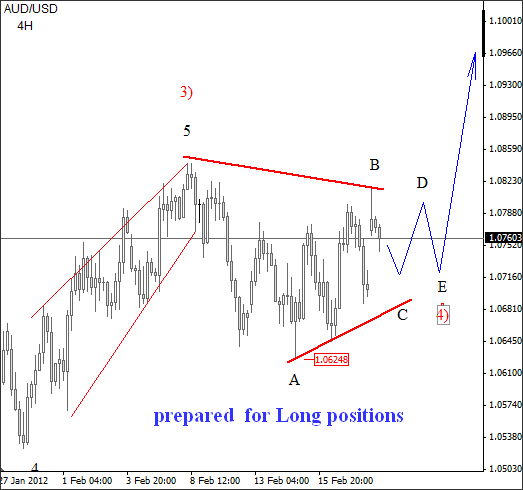

One of it is Aud/Usd for Longs against 1.0620.

Do you want more analysis? Then, please join us on http://www.ew-forecast.com or follow us on twitter