EUR/USD is trading on high ground and dips have not seen a breach of the important 1.1050 level.

Nevertheless, the team at SEB says it is time to fade the EUR/USD correction, providing updated forecasts to the downside:

Here is their view, courtesy of eFXnews:

In its weekly FX note to clients, SEB Group outlines its outlook on the ongoing EUR/USD correction, arguing that at current levels, it’s time to fade it. The following are some of the key points in SEB’s note along with its forecasts for EUR/USD.

1- The correction higher in EUR/USD which began a few weeks ago occurred after a very long period (almost a year) in which EUR/USD trended lower, due to additional easing by the ECB and expectations of tighter US monetary policy.

2- Indeed several, such as the oil price or European bond yields have turned around in recent weeks, to move in a dollar-negative direction. Most likely the shift in these drivers combined with an increased risk that US economic weakness is in fact both more severe and more widespread than most had anticipated, with an associated impact on Fed expectations, have hit the dollar hard as the market clearly held a very long position in the currency.

NOW WHAT?

3- Going forward we maintain our view that the dollar will recover and EUR/USD eventually breaks below previous lows. The oil price is unlikely to move much higher after surging USD 20/bbl since February. Several indications suggest the new Brent equilibrium price will be established around USO 70/bbl,near its current level.

4- Moreover, we expect German bond yields to fall back from current levels as the ECB will continue to buy large quantities for a considerable period. This should cause increasing rate differentials between the US and Germany to support the dollar.

5- Finally, we expect weak US economic activity in Ql to recede in coming quarters and demand to recover going forward.

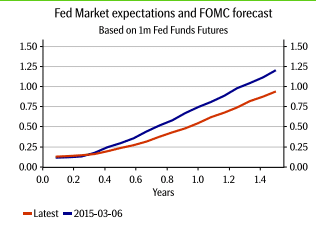

6- Such a development should trigger a re-pricing of Fed expectations, with market prices movingtowards our forecast of a first Fed rate hike in September, followed by a second before the turn of the year. With positioning in USD far from previous extremes this development should attract new USD buyers going forward,which is why we remain positive to the USD.

EUR/USD Forecasts:

We still expect EUR/USD to move back below 1.10 by the end of 02, and even continue below parity before the year-end.

For lots more FX trades from major banks, sign up to eFXplus

By signing up to eFXplus via the link above, you are directly supporting Forex Crunch.